Construction index grows but price pressures persist

Puerto Rico’s construction industry continued its upward trend in June, showing resilience despite mounting cost pressures and fiscal challenges, according to the latest Coincident Construction Index.

Economist Ángel Rivera-Montañez said that “overall, industrial activity continues to increase but is being overshadowed by the negative effects of high construction prices, cuts in public spending and cuts in construction investment.”

He said that while growth remains steady, several risks could slow momentum in the coming months.

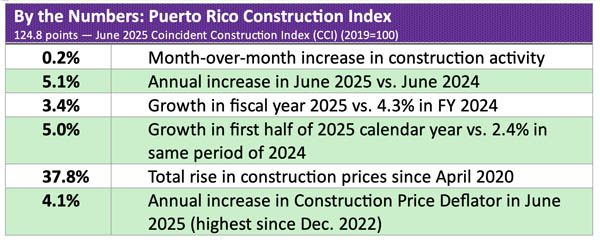

The June index rose 0.2% from May, with a revised figure of 124.8 points (2019=100). Year over year, it was up 5.1%, signaling further acceleration.

Growth was supported by strong salaried employment, cement sales and housing unit sales in the first half of 2025. Construction materials sales, which had declined through much of 2024, are now showing signs of recovery.

The long-term averages also reflect this positive trend. For fiscal 2025, the index grew 3.4%, compared to 4.3% in the prior fiscal year. For the first half of calendar year 2025, the growth rate was 5%, more than double the 2.4% posted during the same period in 2024.

However, Rivera-Montañez warned that rising prices remain a major challenge. The Construction Price Deflator Index rose 4.1% year over year in June, its steepest increase since December 2022, when the rate hit 4.3%.

“Since prices began to rise following the peak of the pandemic in April 2020, they have increased by 37.8%,” he said.

Although the deflator remained unchanged month over month, the sustained annual increases highlight the cost burden facing the industry.

Rivera-Montañez cautioned that new tariffs on construction materials are expected to add to those pressures.

“Expectations point to an increase in this level, as the effects of the imposition of new tariffs on construction materials are reflected in it,” he said, adding that potential reductions in federal reconstruction funding tied to new fiscal policies could dampen investment and stall progress.

“The recent tariff impositions threaten to trigger a further spike in prices for basic construction materials. This, coupled with a potential reduction in federal funding for reconstruction, could slow the industry and stall the process,” he said.

Despite the positive readings, Rivera-Montañez said uncertainty remains high.

“Constant changes in trade policy, along with the impact of tariffs on the entire business and economic structure, remain to be seen, while the level of uncertainty remains high,” he said.

Composite indices such as the Coincident Construction Index are widely used to gauge short-term economic conditions, predict changes in activity, establish turning points and cycles, and assess the long-term impact of public policies and external shocks.

“Analyzing a single indicator alone does not provide the necessary capacity to determine the economic state; for this, composite indices are the best tool available and are easy to interpret,” Rivera-Montañez said.