Fitch: Puerto Rican banks to face ‘continuing’ challenges

Puerto Rican banks will be forced to maintain high capital levels to absorb shocks. (Credit: © Mauricio Pascual)

Fitch Ratings expects Puerto Rican banks to face continuing operating challenges in 2013, despite recent efforts by those institutions to build capital and de-risk their balance sheets, the agency said in a statement issued Wednesday.

“Weak economic fundamentals in Puerto Rico will likely persist this year, and banks will face ongoing risks of rising asset quality pressure,” the credit ratings agency said, while pointing toward the issue of the island’s ongoing recession, the public deficit and the unfunded pension system.

“These issues threaten to restrain GDP growth in coming years, potentially delaying a recovery in the island’s weak labor market and a rebound in real estate prices,” Fitch said. “The Puerto Rican unemployment rate, while down from post-financial crisis highs, remains above 13 percent.”

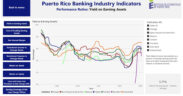

In light of the weak macro backdrop, as well as commercial and residential real estate markets that remain stressed, Puerto Rican banks will be forced to maintain high capital levels to absorb shocks that could drive net charge-off (NCO) and nonperforming loan (NPL) levels higher in 2013, the agency further noted.

“Although growth in problem assets slowed in 2011 and 2012, NPLs remain stubbornly high, and NCOs could increase if the island’s economic growth falters and financial pressure on borrowers builds. We believe reserve levels will remain higher than comparable figures for U.S. mainland banks,” Fitch said in its assessment of the island’s banking sector.

In its analysis, the agency re-stated the widely known fact that the majority of Puerto Rico’s problem loans are related to commercial real estate and construction lending, which were affected by the recessionary period that began in 2006.

“While non-accrual loans in residential home lending remain high at 7 percent for total residential mortgages for all banks, NCOs have not risen significantly,” the credit ratings agency said.

“This reflects the fact that the Puerto Rican housing market has limited rental properties on the island. Borrowers have few housing options and generally are committed to remain in their homes despite financial pressures,” Fitch pointed out.

“Most banks have stated an average self-cure rate of 70 percent for residential nonperforming loans. In addition, conventional mortgages account for 85 percent of home loans on the island as Alt-A loan products were not used as extensively as they were on the U.S. mainland,” the New York-based firm said.

Still, Fitch said the prolonged recession and the island’s weak economic prospects “may have negative implications for future trends regarding net losses from residential mortgages.”

The agency conceded that consumer and commercial lending performance has held up reasonably well through the economic downturn. Excluding residential mortgages, consumer nonaccruals (NALs) for all commercial banks in Puerto Rico remain low at roughly 1.0 percent of total loans in third-quarter 2012, Fitch said.

Commercial and industrial loans are also holding up with NAL estimated at 2.5 percent for third-quarter 2012.

None of the three Puerto Rican banks rated by Fitch — Popular Inc., First Bancorp, and Doral Financial Corp. — currently have an investment-grade rating, Fitch noted.