GAO: Puerto Rico cuts debt by $12.5B as finances improve, risks persist

Puerto Rico has reduced its public debt by $12.5 billion and posted a $1.9 billion surplus in fiscal year 2022, signaling strong progress since the 2015 debt crisis. But unresolved structural challenges continue to threaten the island’s financial stability, according to the U.S. Government Accountability Office (GAO).

Testifying before the U.S. House Subcommittee on Indian and Insular Affairs, GAO Director of Strategic Issues Michelle Sager outlined the gains made under the federal Puerto Rico Oversight, Management and Economic Stability Act (Promesa), which established the Financial Oversight and Management Board (FOMB) for Puerto Rico in 2016. She also warned of enduring risks related to high energy costs, declining population and weak financial reporting.

Sager explained that Puerto Rico’s financial collapse stemmed from years of chronic deficits, poor fiscal oversight and policy decisions that allowed the government to use debt to fund operating expenses.

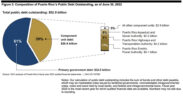

Since Promesa’s enactment, Puerto Rico has cut its debt from 93% of gross national product in 2016 to 67% in 2022 — a 19% reduction. A key step in that process was the 2022 issuance of $7.4 billion in new general obligation bonds, replacing $34.3 billion in legacy debt. That same year, a pension reserve trust was created and funded with $3.4 billion to support future pension payments and eliminate pension liabilities by 2039. According to the GAO, these actions reduced the debt burden and provided more manageable repayment terms.

Sager told lawmakers that Puerto Rico’s real gross national product grew 2% in fiscal year 2024, while real GDP rose 3%, continuing a three-year growth trend. The GAO attributed much of this economic activity to increased federal assistance following Hurricane Maria and the COVID-19 pandemic. In fiscal 2022 alone, the island received $25.9 billion in federal aid.

Despite those gains, the GAO warned of high electricity costs — averaging 29 cents per kilowatt-hour, nearly double the U.S. average — and frequent service interruptions that continue to affect business operations, public services, and overall growth.

Population decline remains a critical concern. Since 2008, Puerto Rico’s population has decreased by more than 800,000 residents due to migration, lower birth rates and higher death rates. A shrinking population reduces the government’s tax base, workforce and consumer demand.

The GAO highlighted improvements in fiscal governance under the FOMB. As of fiscal year 2023, the oversight board certifies the central government’s budget, reviews legislation for compliance with fiscal plans, and can prevent spending that would violate those plans.

In 2022, the government adopted a new debt management policy that caps debt service at 7.94% of average government revenue and limits long-term debt issuance to capital improvement projects.

However, the report also raised concerns about delays in audited financial reporting. While some audits have improved, others — including the University of Puerto Rico’s — remain behind schedule. The GAO noted that several government agencies have faced repeated compliance issues related to federal grant management.

Efforts to implement a centralized enterprise resource planning (ERP) system are still in progress. Although more than 50 agencies are connected to the system, the GAO cautioned that “delays may continue to hinder transparency, accountability, and financial reporting.”

The electric power sector remains one of the most serious unresolved issues. The Puerto Rico Electric Power Authority (PREPA) is still undergoing debt restructuring, while residents and businesses continue to face elevated costs and unreliable service. According to the GAO, unresolved energy challenges and the outcome of PREPA’s debt deal could have “far-reaching implications for Puerto Rico’s economy and fiscal health.”

While acknowledging significant fiscal improvements, the GAO emphasized that “challenges remain that pose risks to Puerto Rico’s long-term financial future,” including the need for reliable electricity service, a stable population, and improved financial management.

The report concluded that “sustained progress toward long-term fiscal health will depend on improved fiscal governance, reliable electricity service, stable population levels and economic development.”