Puerto Rico economy grows as jobs rise, housing costs surge

Federal Reserve Bank of New York analysis highlights post-pandemic recovery and affordability concerns

Puerto Rico’s economy has entered a period of sustained growth following years of contraction, according to an analysis presented by Joelle Scally, economic policy adviser at the Federal Reserve Bank of New York, during an economic symposium hosted by the Financial Oversight and Management Board for Puerto Rico.

The report cites strong job creation, rising home prices and signs of population stabilization as key indicators of recovery.

“After a decades-long decline, Puerto Rico’s economy has begun to grow,” the report states, noting that private employment is at an all-time high.

From February 2020 to March 2025, nearly every major industry added jobs, with particularly strong growth in education, health care, manufacturing and tourism-related sectors.

The island’s labor force also expanded during this period. According to Bureau of Labor Statistics data cited in the report, Puerto Rico’s labor force now exceeds 1.4 million people. Government jobs, which made up 29% of employment in 2004, now account for 20.5% as private sector hiring increases.

Population trends, which had been in steady decline since 2006, are showing signs of stabilization. Census estimates and alternative data suggest that improved economic conditions and job growth have slowed the pace of population loss.

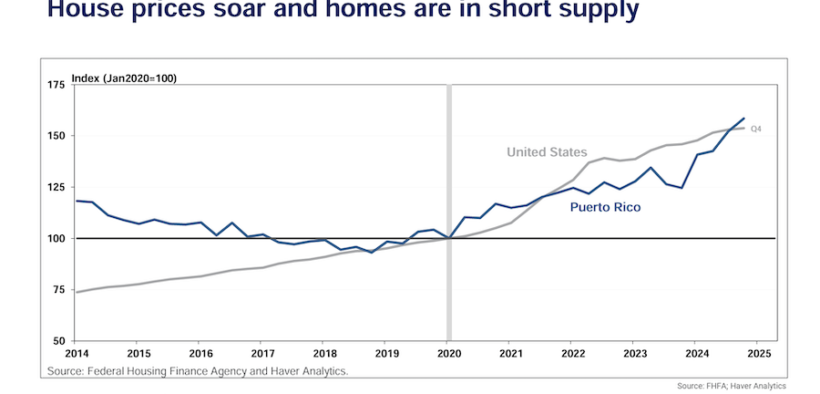

However, the recovery has also increased demand for housing. Since 2020, home prices have climbed more than 50%, according to the Federal Housing Finance Agency. This rate of growth exceeds the U.S. mainland trend and has contributed to supply shortages and affordability challenges.

Credit conditions remain mixed. Forty-seven percent of residents have credit cards, 35% have auto loans and only 18% have mortgages, compared to 63% and 30% respectively on the mainland.

The average mortgage balance in Puerto Rico is $106,054, significantly lower than the mainland average of $258,201. However, the average auto loan balance is higher — $26,619 compared to $23,806.

Student loan delinquencies, which declined during the pandemic due to federal relief, have now returned. According to data from the New York Fed Consumer Credit Panel, more residents are falling behind on student loan payments, reversing the artificially low delinquency rates of recent years.

Scally noted that newly delinquent auto and credit card balances are now slightly higher in Puerto Rico than on the mainland. Mortgage delinquency remains elevated, at more than 6% as of early 2025.

Despite these challenges, the report concludes that Puerto Rico has experienced a “broad-based return to growth.” Labor force participation has expanded, and population decline appears to have slowed. Consumer delinquencies, while rising, have recently stabilized.

“Economic and revenue forecasting are critical for fiscal and budget planning,” said Robert F. Mujica, executive director of the federally appointed fiscal panel for the island. “It is important for the government and the oversight board to hear different perspectives and views on the United States and Puerto Rico economies going forward to establish a consensus forecast that will help us develop a realistic and effective budget.”