Op-Ed: Puerto Rico, the sum of its parts

Economist Heidie Calero is president of H. Calero Consulting Group, and author of this column. (Credit: © Mauricio Pascual)

Puerto Rico’s economic situation raises serious questions about the capacity of policymakers to get it under control. Third quarter indices reveal a mixed picture. The economy continues stagnant. Full recovery will depend not only on internal but also on external factors originating in the U.S. and other global economies. There is increasing dissatisfaction with local economic policies, escalating electricity prices, and persistently high unemployment.

These factors, together with safety concerns and pessimism about the economic future have motivated mass migration to the U.S. mainland. Government has focused principally on the island’s fiscal issues, including liquidity concerns regarding the Government Development Bank (GDB). However, a perfectly balanced budget will mean nothing amidst a devastated economy. This issue addresses the urgent v. important economic issues and tracks the 3Q of the Puerto Rico economy.

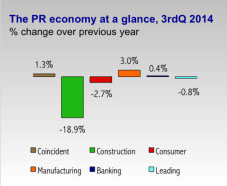

The economy at a glance

The third quarter indices for 2014 depict negative performances in three of HCCG six indices. The Coincident index posted a 1.3 percent growth driven by tourist registrations and number of working hours. Construction still has not taken off and fell –18.9 percent. With an upcoming tax reform that will tax consumption more, we expect the Consumer index to continue posting negative growth as it did this quarter with –2.7 percent. The Banking index fell –0.4 percent while the Manufacturing index surprisingly posted a 3.0 percent increase, its best performance in several years. However, announcements of plant closings and manufacturers leaving Puerto Rico create the concern that this trend may not continue.

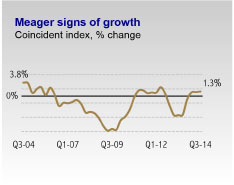

Current state of the economy

The Coincident index summarizes the current state of Puerto Rico’s economy. It posted a positive yet anemic growth of 1.3 percent in Q3. The economy continues to balance a relatively stable growth in tourism, job losses, and a sluggish construction sector. Hotel registrations posted positive growth of 8.8 percent in Q3-2014 compared with Q3-2013. Manufacturing payroll grew 11.8 percent, driven by more working hours but zero job creation. Employment in construction, trade, and services fell -2.4 percent and cement sales fell –13.2 percent in Q3 2014.

During this quarter, the private sector lost 9,300 jobs compared with Q3-2013. This loss, together with 24,000 less jobs in the public sector amounted to 33,330 jobs lost this quarter.

Besides public and private job losses, the labor participation rate hit an all-time low of 39.6 percent in September. Puerto Rico is among the 10 countries in the world with the lowest participation rate. Countries like Panama, Dominican Republic or Venezuela have more than 65 percent participation rates. Puerto Rico also performed below the 63 percent average in the U.S. mainland.

We need to attract that pool of available labor. Sadly, the fiscal crisis, including the public debt and liquidity constraints have taken so much time of government officials that not enough attention has been paid to economic initiatives. For example, the presentation for the last Commonwealth of Puerto Rico’s Update on Fiscal and Economic Progress assigned only 11 slides or 16 percent of the presentation to economic development measures, while liquidity concerns, finance, plan, HTA & Puerto Rico EPA update, budget & tax reform, among others took the remaining 84 percent of the presentation.

We need to attract that pool of available labor. Sadly, the fiscal crisis, including the public debt and liquidity constraints have taken so much time of government officials that not enough attention has been paid to economic initiatives. For example, the presentation for the last Commonwealth of Puerto Rico’s Update on Fiscal and Economic Progress assigned only 11 slides or 16 percent of the presentation to economic development measures, while liquidity concerns, finance, plan, HTA & Puerto Rico EPA update, budget & tax reform, among others took the remaining 84 percent of the presentation.

Another prove of fiscal oriented work is that in the last 29 press releases in the GDB web page, 23 or 79 percent of them were fiscal related while only 6 press releases cover other issues including economic activity indicators. Government liquidity is an urgent topic but economic development is urgent and more important.

According the current administration’s economic roadmap, the major job creating industries are manufacturing, export services and tourism. In the tourism sector, gains in hotel registrations in Puerto Rico mirror the dynamics of tourism worldwide. According to the World Tourism Organization, tourist arrivals last year grew 5 percent and $1.4 trillion in exports generated many jobs. The Caribbean ranks among the top-three most popular destinations in the world. However, Puerto Rico has lost ground and is behind the Dominican Republic. Industry executives agree that tourism needs to be overhauled. Non-traditional tourist packages including ecotourism and medical tourism are being promoted by the Puerto Rico Tourism Company.

No rebound in construction

The construction index remained in a free fall of -18.9 percent this quarter. Construction job losses (-23 percent) continued with many projects put on hold or canceled, and huge delinquency in construction loans remained high. Cement sales fell –13.2 percent; the number of new housing permits and the value of construction permits fell –29 percent and –2.0 percent, respectively.

Some good news for the future include: Crowley Maritime Corp., which issued a request for proposal (RFP) for contractors to build a 900-foot new pier and install three gantry cranes at its Isla Grande port. El San Juan Resort & Casino in Isla Verde is undergoing a $13 million renovation. Dozens of new businesses in Santurce, including restaurants, cafes, vintage boutiques, and bookstores, have flourished in recent years. The Ciudadela condominium, purchased by Nicholas Prouty, was sold out as of September 2014. Prouty plans to invest $114 million in a second phase of this project with 252 new apartments, 50,000 square feet of retail space, and a public park.

Consumers facing tax reform

Consumers facing tax reform

The Consumer index fell -2.7 percent in Q3-2014 showing the vulnerable status of this sector. As of September 2014, the number of commercial bankruptcies grew 2.9 percent or 32 bankruptcies.

The Commonwealth has embarked on an aggressive agenda to pass a comprehensive tax reform in Q3 of fiscal year 2015 (Jan-Mar 2015). The main objective is to streamline Puerto Rico’s tax structure and maximize revenues. The Treasury Department, together with OMB and GDB, is working with KPMG to recommend a tax reform.

According to the GDB, “The reform is expected to materially increase General Fund revenues by shifting the tax regime from taxing work to taxing consumption.” The Reform proposes to raise tax rates, widen the base of the sales tax; reduce individual and corporate income taxes; find alternatives to Act-154; and overhaul and increase property taxes.

No word yet as to the impact of the proposed tax changes on the retail and wholesale sectors, which account for approximately one quarter of total employment, and support thousands of indirect jobs in other industries. In 3Q-2014, restaurants, apparel and gas stations showed positive change in retail sales while other categories posted 0 to -11.9 percent reductions.

Surprise surge in manufacturing

The Manufacturing index grew 3.0 percent this quarter. Despite a fall of -0.8 percent in manufacturing jobs and -2.9 percent in industrial electricity consumption, other components of the Manufacturing index were positive. Total exports, manufacturing payroll, and average working hours surged with 16.5 percent, 11.8 percent, and 6 percent, respectively.

Eli Lilly Co. announced plans to conclude production and sale of its Guayama plant, one of three operations it has in Puerto Rico. The plant will operate until the end of 2015. In contrast, Actavis plc is investing $48 million to expand operations in Manatí. Aspen Surgical Puerto Rico announced a $3 million investment to improve operational efficiency of its existing plant and manufacturing area. Olein Recovery Corp. announced expansion plans with $2 million investment in modernization of its laboratory and production lines, and 50 new jobs.

Stuck in regulations

Banking indicators continue to reflect the effects of the prolonged recession. Continuation of bank credit tightening is reinforcing the downturn. Our 3Q Banking index estimate barely moved with 0.4 percent and driven by a 17.5 percent increase in capital, 13 percent change in personal loans, and 1.9 percent in auto loans. These positive indicators were overcome by -0.4 percent in deposits, -0.5 percent in credit cards, -3.8 percent in real estate loans, and a plunge of -12.2 percent in industrial and commercial loans.

In Q3 2014, Popular Inc. reported net income of $62.6 million, which was 72 percent below the $229.1 million reported in Q3-2013. In contrast, First BanCorp., reported net income of $23.2 million for Q3-2014, or 46 percent increase compared to $15.9 million in the same quarter of 2013. Doral Financial Corp. shares lost more than 75 percent of its value as of September. In October 1st, they tumbled another 24 percent after the FDIC found it to be “significantly undercapitalized” and in need of an immediate fix. In October 11, Doral rose as much as 50 percent in after-hours trading following a San Juan judge’s ruling that entitled it to a $229.9 million tax refund. Puerto Rico Treasury Department has announced it will appeal.

More turmoil ahead

The Leading Index fell -0.8 percent. This signals no economic recovery likely for the next three to six months. It is the sixth decline on a row. The weaknesses in the components of the index reflect uncertainties regarding the ongoing fiscal crisis, measures that do not seem to work, and continued weakness in domestic demand in the short term. A silver lining is the moderation in the rate of decline in the index compared with the first and second quarters in 2014.

The urgent fiscal issues have relegated economic development to a second or third place. It is time to understand that economic growth and job creation is as urgent and more important than balancing the public finances.

Very informative and insightful analysis.