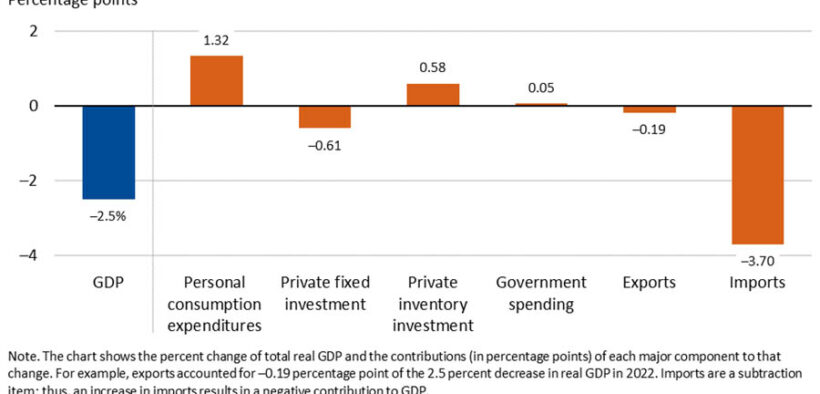

Puerto Rico’s GDP drops 2.5% on higher imports, lower exports

The drop reflected a rise in imports and drops in exports and private fixed investment, according to the Bureau of Economic Analysis.

Puerto Rico’s real gross domestic product (GDP) decreased by 2.5% in 2022, a reversal from a 4.1% increase in 2021, the U.S. Bureau of Economic Analysis (BEA) reported, based on the latest economic statistics for the island.

The decline reflects a rise in imports and drops in exports and private fixed investment (PFI).

Real imports increased 7.3%, led by a 21.7% rise in pharmaceuticals and organic chemicals, which are primary inputs of the pharmaceutical manufacturing industry. The growth in these imports outpaced the industry’s exports, the BEA said.

Real exports fell by 0.3%, reflecting a drop in the export of services, which was partially offset by a rise in the export of goods. The export of services shrunk by 14.6%, while exports of goods grew 2.9%.

The leading contributor to the decrease in exports of services was “other services,” which includes computer services. This was partly offset by a rise in travel services exports, which include purchases of goods and services by tourists and other nonresidents. The export of goods was driven by pharmaceuticals and organic chemicals, which increased 2.6%, the BEA reported.

PFI decreased by 4.6%, with investment in intellectual property products dropping 24.7% and investment spending on equipment and structures rising 4.3% and 2.1%, respectively. For Puerto Rico, investment in intellectual property products consists mostly of research and development spending by computer service providers and other businesses, according to the report.

The leading contributor to higher investment in equipment was information processing equipment, which includes purchases of medical instruments by businesses. Driving the increase in structures was nonresidential structures, reflecting ongoing projects to expand renewable energy generation, the BEA said.

Real personal consumption expenditures (PCE) increased by 2.2%, with expenditures on services rising by 5.5% and expenditures on goods dropping by 0.7%. The leading contributor to the increase was “other services,” which includes recreation services, such as live entertainment, while the decrease in PCE goods was in the motor vehicles and parts category. According to the Economic Development Bank for Puerto Rico, sales of motor vehicles decreased by 4.3% in 2022 after increasing 35.9% in 2021.

Real government spending went up by 0.4% thanks to increases in investment spending by federal, central and municipal governments. These increases reflect growth in disbursements of federal funds for disaster recovery activities associated with hurricanes Irma and Maria in 2017, earthquakes in 2019 and 2020, and Hurricane Fiona in 2022.

Due to lags in the availability of key data sources used in the estimation of Puerto Rico’s GDP, the statistics for 2022 are preliminary estimates, the BEA said. Currently available data sources for central government spending and private inventory investment, for example, do not cover all of calendar year 2022, the bureau noted, adding it would incorporate new information as additional source data become available.

Because Puerto Rico is not included in most of the major surveys used by the BEA, the bureau uses information provided by agencies and organizations such as the Economic Development Bank for Puerto Rico, the Department of Economic Development and Commerce, Discover Puerto Rico, the Puerto Rico Insurance Commissioner’s Office, the Puerto Rico Treasury Department, the Puerto Rico Industrial Development Company, Puerto Rico Institute of Statistics, Puerto Rico Planning Board, Puerto Rico Ports Authority and the Puerto Rico Tourism Company, among others.

Fed holds interest rates steady

In related economic news, the Federal Reserve kept interest rates unchanged on Wednesday, with officials hinting that a long-awaited rate cut might come as soon as September.

The Fed kept its federal funds rate at a target range of 5.25% to 5.5%. This is the ninth time in the last 10 meetings that the Fed has left rates unchanged, though the central bank has raised rates a total of 11 times during this economic cycle to tamp down high inflation.

The Fed’s decision comes as inflation hit 3% year-over-year in June, after reaching its highest levels in decades at more than 9% in mid-2022. The last time the Fed raised rates was at its July 2023 meeting.

Although borrowing costs are at their highest level in 23 years, the Fed has been wary of taking pressure off the economy before central bank officials are confident that inflation is heading back to normal levels.

At the end of its two-day policy meeting, the Fed said the economy was still growing at a “solid pace” and that the unemployment rate had ticked up slightly but remains low. Even though inflation has eased, the path ahead is still uncertain, the Fed said in a statement.

“The committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” the Fed said.

The last time officials convened, in June, they hinted they would cut rates before the end of the year, down from three a few months before that. The Fed will meet again in September.

The U.S. economy grew 2.8% in the second quarter, marking two years of expansion.

Although we are looking at a 2022 GDP picture, Retail Sales, which is one of the leading indicators to 2024’s GDP performance, is not showing promise. Most recent, the Puerto Rico Planning Board presented a March 2024 Nominal Retail Sales figures showing a drop of 3.7% year over year. This number, when accounting for an inflation figure estimated at 2%, yields a Real year over year drop closer to a 5.7% number. A dismal indicator…

It is estimated that the drop would have been greater if not for the significant 56.2% increase in the sale of electronic goods. Which may in itself be an indicator of another situation, the replacement of electronic home goods due to the widely experienced power surges and fluctuations, resulting in damages to all sorts of electronic goods from alarm clocks to refrigerators. A topic unto itself.

Our economy needs a boost in the consumption category. Lower year over year Retail Sales may indicate a disposable income spending shift reflecting the population’s need for survivability under uncertain times. Let’s hope the trend can be reversed sooner rather than later.