Puerto Rico’s Truman Show: Stuck in fiscal déjà vu

Fifty years ago, the Tobin Report, commissioned in 1975 and led by Nobel laureate James Tobin, warned Puerto Rico of the urgent need for deep fiscal reform and economic restructuring.

It laid bare the mounting structural imbalances that threatened the island’s prosperity: ballooning government spending, unsustainable pension and welfare costs, soaring labor expenses and an overreliance on federal transfers and external capital.

The report’s prescriptions were clear yet difficult — austerity, wage freezes, pension reform, government spending cuts, tax increases and a bold shift toward cultivating local entrepreneurship and capital markets.

Puerto Rico remains trapped in a “The Truman Show”-like cycle, endlessly reliving the same governance failures Tobin outlined. Among the most glaring failures has been the island’s neglect of pension reform, a problem Tobin identified as critical.

The government’s pensions have become overwhelming liabilities that drive public service costs and contribute to fiscal crises decades later. The LUMA Energy rate increase, currently in effect, partly covers these pension costs and has pushed electricity bills higher — already among the highest in the U.S. — impacting a population already burdened by economic hardship.

Pension debt, weak markets fuel fiscal stagnation

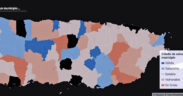

The fiscal challenges extend across Puerto Rico’s 78 municipalities, documented by ABRE Puerto Rico’s Municipal Fiscal Health Index. ABRE is a nonprofit organization that compiles and analyzes audited municipal financial statements to measure fiscal health based on key metrics like fund balances, debt levels, revenue diversity and budget management, enhancing transparency and accountability.

The 2023 ABRE index found nearly 40% of municipalities remain fiscally vulnerable or in crisis, improving modestly from around 60% vulnerability two decades ago. These local government challenges reflect Tobin’s warnings of systemic fiscal imbalances throughout government layers, with shrinking tax bases and constrained resources threatening service delivery.

Several other Tobin Report warnings have likewise been realized. Rising public debt led to the creation of the Promesa oversight board, while unchecked labor cost increases undermine competitiveness. Dependence on federal transfers perpetuates economic stagnation, and underinvestment in infrastructure has degraded essential services, including power, water and transportation.

The absence of robust local capital markets limits financing options, further constraining development and entrapping Puerto Rico in external aid cycles.

Despite Promesa’s role, political gridlock and entrenched interests stall meaningful reform, causing Puerto Rico’s governance cycle to repeat unchecked and the population to bear persistent inequalities and instability.

A critical missed opportunity remains: the establishment of a Puerto Rico Stock Exchange. As I argued in my August News is my Business piece, such a market would enable startups, midsize companies and investors to raise capital locally, fostering entrepreneurship and diversifying the economy.

Singapore’s stock exchange exemplifies this potential, underpinning the city-state’s rise as a financial powerhouse with superior GDP growth and innovation-driven development. In the United States, Texas is preparing to launch the Texas Stock Exchange in 2026, backed by influential financial firms aiming to attract capital and listings to enrich the state’s economy.

Puerto Rico could adopt a similar model, equipping sectors like fintech, manufacturing, renewable energy and tourism with equity financing to enable sustainable growth.

Without this institutional innovation, Puerto Rico has remained dependent on external capital and aid, impeding economic sovereignty. The fiscal crises driven by unchecked pension burdens and government overspending might have been alleviated by a robust private sector supported by local capital markets.

The LUMA rate increase covering pension costs starkly illustrates the tangible costs of decades of deferred reform Tobin warned against. To break free from this “Truman Show” governance cycle, Puerto Rico must embrace genuine fiscal responsibility — pension restructuring, spending control, tax reform and developing financial institutions that empower local economic agency.

Tobin’s vision remains indispensable. Only through timely and comprehensive fiscal reform coupled with capital market development can Puerto Rico transform governance from a repetitive crisis script into a true narrative of prosperity, self-reliance and dignity.

Antonio Santos is a hospitality and tourism professional with more than 30 years of experience in Puerto Rico’s service industry. In 2024, he ran for the Puerto Rico House of Representatives representing District 1 in San Juan with the conservative Proyecto Dignidad party. He advocates for entrepreneurship and policies focused on small government and economic self-sufficiency, combining industry experience with a focus on sustainable development and opportunity on the island.