Its new platform combines financing and payment processing. #NewsismyBusiness

Digitization is not only changing the way companies sell their products and services to customers, but also how companies sell to other companies. So, we face a new panorama in the world of business-to-business or B2B. Today, like all of us, commercial buyers need to only do a search on Amazon, to easily find all […]

The Association of Insurance Companies of Puerto Rico (known as ACODESE for its Spanish acronym) blasted Gov. Alejandro García-Padilla’s decision to veto House Resolution 2698, which would have confirmed the exemption of medical services from the 4 percent business-to-business tax.

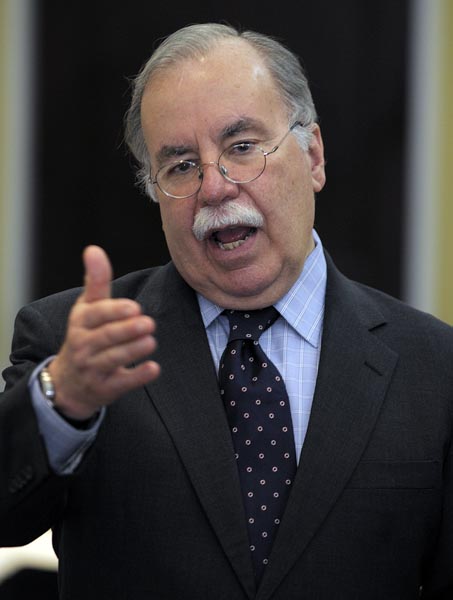

The switch-over from a B2B IVU to a B2B IVA should not raise consumer prices nor costs to business, according to Economist Vicente Feliciano, president of Advantage Business Consulting.

On April 1, Puerto Rico will adopt a Value Added Tax (VAT) system and the island's advertising industry will fall in line with other business sectors in paying a tax for services from which it was temporarily exempted.

Since going into effect last October, the Sales & Use Tax (SUT) on business-to-business (B2B) services has generated $26.4 million, the Puerto Rico Treasury Department reported.

Representatives from Puerto Rico’s telecommunications sector presented a united front Tuesday against the proposed elimination of the business-to-business tax exemption, saying “far from helping the island solve its fiscal problems, it will trigger a double-digit increase in the price of products, services, operating expenses and the cost of living in general.”

The Puerto Rico Treasury Department is currently working on a number of enforcement and automation initiatives to increase the island’s sales and use tax uptake from the current 68 percent while attacking the government’s fiscal shortfall, agency Secretary Melba Acosta told participants of the Puerto Rico Credit Conference Friday.

The head of the Puerto Rico Society of CPAs expressed concern Wednesday over the changes the current administration is proposing to the sales and use tax structure, specifically, the elimination of the business-to-business exemption.

NIMB ON SOCIAL MEDIA