New oversight board members inherit unresolved PREPA crisis, debt turmoil and political scrutiny. #NewsismyBusiness

A “business as usual” bond deal is about to be foisted upon Puerto Rico’s ratepayers and fledgling economy. It will result in a $400 million annual cash draw for at least the next 20 years. Think about wasting money on overpriced oil, political appointees and useless consultants over the last twenty years and then paying for […]

The Financial Oversight and Management Board for Puerto Rico and the government of Puerto Rico announced they have reached a deal with Senior and Junior bondholders of Sales Tax Financing Corp. credit, as well as monoline insurers.

The Financial Oversight and Management Board for Puerto Rico, the Puerto Rico Electric Power Authority, and the Fiscal Agency and Financial Advisory Authority have reached an agreement with the Ad Hoc Group of PREPA bondholders.

Puerto Rico Electric Power Authority bondholders can expect to recover about 35 percent of their investments due to the business disruption and costs, as well as lost revenues related to damage caused by Hurricanes Irma and María, Moody’s Investors Service predicted in a report released Thursday.

Puerto Rico’s debt service payment could be reduced to zero in the short-term, when the Financial Oversight and Management Board for Puerto Rico modifies the fiscal plan to readjust it to the island’s new panorama following the humanitarian crisis provoked by the passage of a category 4 hurricane through the island.

The Puerto Rico Electric Power Authority (PREPA) Bondholder Group announced that its members have offered a debtor in possession (DIP) financing loan to the public corporation to help address the urgent need to repair the power grid in the wake of Hurricane María, following Hurricane Irma.

If Puerto Rico thinks bankruptcy is a better solution, they have a rude awakening coming. One should look no further than the Puerto Rico Electric Power Authority’s (PREPA) pending bankruptcy.

George Pataki, Former New York Gov. and advisor to Ad Hoc Group Of Puerto Rico General Obligation Bondholders, Issued a memorandum saying Gov. Rosselló and the Fiscal Board are acting in bad faith.

The Puerto Rico Electric Power Authority provided additional detail on its previously announced extension and supplement to its restructuring support agreement (RSA) with the ad hoc group of PREPA bondholders, the fuel line lenders, the monoline insurers and the Government Development Bank for Puerto Rico.

The COFINA Seniors Coalition on Wednesday filed a motion to join litigation already pending in the U.S. District Court in Puerto Rico — Lex Claims, LLC et al. v. Garcia-Padilla et al. — to expose what they called “meritless, self-serving claims brought by a litigious faction” of General Obligation ("GO") bondholders.

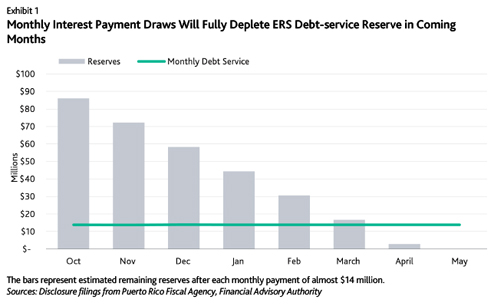

In the coming months, the Commonwealth of Puerto Rico will default on bonds issued by its Employees Retirement System following the steady depletion of the bonds' debt service reserves, Moody’s predicted.

The Ad Hoc Group of Puerto Rico General Obligation bondholders addressed a memo Tuesday to island policymakers claiming the unconstitutionality of the Sales Tax Financing Corp., known as COFINA, and asking for its invalidation.

The Puerto Rico Electric Power Authority, Puerto Rico’s publicly owned electricity provider, announced Thursday an extension of the Restructuring Support Agreement to March 31, 2017.

NIMB ON SOCIAL MEDIA