Sales Tax Financing Corp. bondholders submitted an Agreement in Principle in the U.S. District Court in Puerto Rico, potentially ending its dispute with the island’s government.

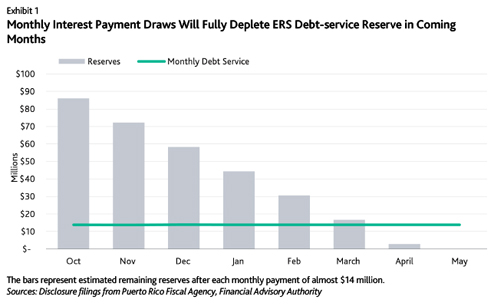

In the coming months, the Commonwealth of Puerto Rico will default on bonds issued by its Employees Retirement System following the steady depletion of the bonds' debt service reserves, Moody’s predicted.

While admitting that there isn’t much the Federal Reserve Bank of New York can do to spur economic growth for the island, William Dudley, the head of the regulatory agency, said Tuesday he is “confident that Puerto Rico has started on the road to recovery.”

The Puerto Rico Commission for the Comprehensive Audit of the Public Credit sent a letter Monday to the Financial Oversight and Management Board for Puerto Rico outlining its work so far, including two preliminary audits that it hopes the federally appointed body will review.

Puerto Rico Gov. Alejandro García-Padilla announced Thursday he has turned over several documents detailing the island’s fiscal situation to the fiscal oversight board, a day ahead of the federally appointed body’s first meeting today.

Following the Puerto Rico government’s confirmation Tuesday that negotiations with Rico Sales Tax Financing Corporation (known as COFINA) and General Obligation bondholders had broken off, both creditor groups went public to defend their positions on the ongoing talks.

An independent commission established by Puerto Rico's government has issued a report casting doubt on the legality of the island's debt, which could be declared null by a court if it decides the Commonwealth borrowed without authorization.

Puerto Rico is facing a severe fiscal crisis. Observers agree that the island’s public entities are unable to repay their debts on time and in full, making default and debt restructuring inevitable.

Members of the government’s Working Group for the Fiscal and Economic Recovery of Puerto will release today details of a revised voluntary exchange proposal presented to advisors to the Commonwealth’s creditors in March.

New York-based Ambac Financial Group Inc. on Thursday filed a lawsuit to protect its rights against what it deemed the “illegal" clawback of certain revenue by the Commonwealth put into effect last month.

The government of Puerto Rico will make most of its $1 billion debt payment due Jan. 1, defaulting only on some $37 million of the amount, Gov. García-Padilla said Wednesday.

BlueMountain Capital Management, LLC filed a lawsuit on Tuesday against the government of Puerto Rico, challenging the legality of a new law that allows certain public corporations to avoid their debts.

The Puerto Rico Treasury Department announced Tuesday it has submitted the Commonwealth’s audited financial statements for the fiscal year 2012-2013 that ended June 30, 2013.

Gov. Alejandro García-Padilla filed Wednesday at the Legislature the “Puerto Rico Public Corporations Debt Enforcement and Recovery Act,” to create a clear legislative framework to assist financially stressed public corporations overcome their problems “through an orderly, statutory process” that allows them to handle their debts fairly and equitably, while ensuring the continuity of essential services to citizens and infrastructure upgrades.

NIMB ON SOCIAL MEDIA