New law aims to improve liquidity and coordination for cooperatives under financial stress. #NewsismyBusiness

The meeting comes after a new regulatory interpretation of the Federal Housing Financing Agency (FHFA) came into force last month. #NewsismyBusiness

This clarity provided by the FHFA makes it easier for Puerto Rican cooperatives to access financial services and stability. #NewsismyBusiness

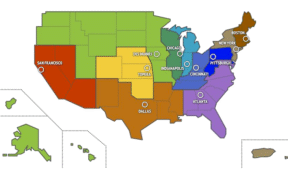

The meeting was part of the joint work and collaboration agreements that have been carried out with the neighboring country’s credit union system. #NewsismyBusiness

The agreement looks to protect the cooperative sector from cyberthreats. #NewsismyBusiness

The training sessions aim to prevent exploitation and scams. #NewsismyBusiness

Most sectors of the economy have shown year-over-year growth and consistency. #NewsismyBusiness

The agreement was signed June 10.

COSSEC confirmed the “solidity and solvency of the credit union system.”

The Pontifical Catholic University of Puerto Rico’s Legal Assistance Clinic and the Public Corporation for the Supervision and Insurance of Puerto Rico Cooperatives (COSSEC, in Spanish) have reached a first-time agreement to establish an internship program for law students. Through the agreement, participating students will gain experience in administrative and civil law evaluating complaints presented […]

The Public Corporation for the Supervision and Insurance of Puerto Rico Cooperatives (COSSEC, in Spanish) confirmed that local credit unions will be able to access some $3 billion in budgetary allocations included in the new federal economic stimulus package that seeks to revitalize communities with low and moderate resources. The federal funding bill allocates $3 […]

Puerto Rico’s credit unions have more than 1 million members, according to the latest financial and statistical quarterly report presented by the Public Corporation for the Supervision of Puerto Rico Cooperatives, or COSSEC for its initials in Spanish. This achievement is part of the goals set by past Cooperative Development Commissioner, or CDCoop, Ivelisse Torres-Rivera, […]

The Public Corporation for the Supervision of Puerto Rico Cooperatives, or COSSEC as the entity is known in Spanish, confirmed it is drafting a “fiscal stability plan” where the sector will present strategies to stabilize the island’s co-op system and its more than 1 million members.

Due to the possibility of a government default on some $2 billion in debt service due July 1, Puerto Rico credit unions confirmed they have enough financial capacity to face the situation, with $486 million in reserves to face possible investment losses.

The Public Corporation for the Supervision of Puerto Rico Cooperatives, or COSSEC as the entity is known in Spanish, said Tuesday that the island’s credit unions approved some $1.3 billion in mortgage and mortgage-related loans during the first quarter of 2015, for a combined portfolio of 18,385 financing agreements.

NIMB ON SOCIAL MEDIA