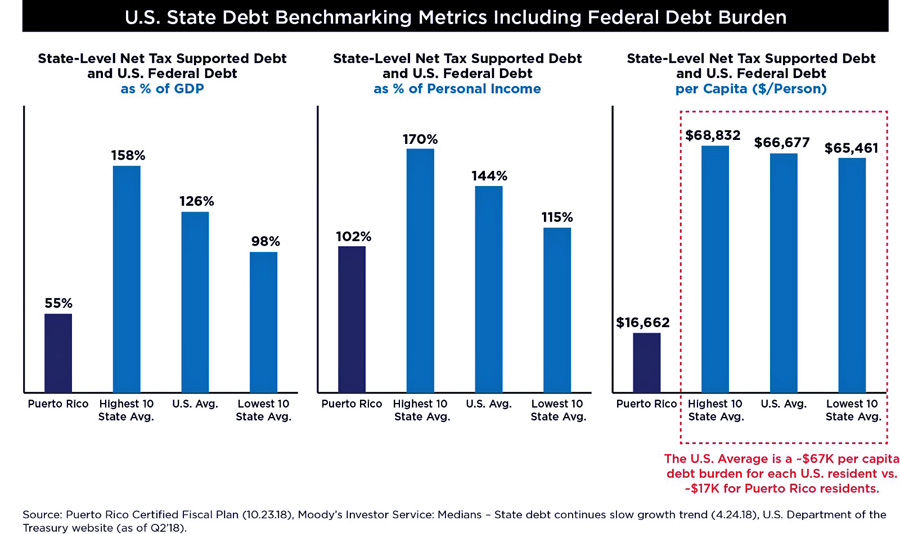

Recent discussions of Puerto Rico’s debt levels by both Puerto Rico officials and the Financial Oversight and Management Board for Puerto Rico represent that the island’s per capita debt levels are far higher than the average per capita levels of mainland states in the U.S. mainland. However, that analysis compares only state-level debt and ignores […]

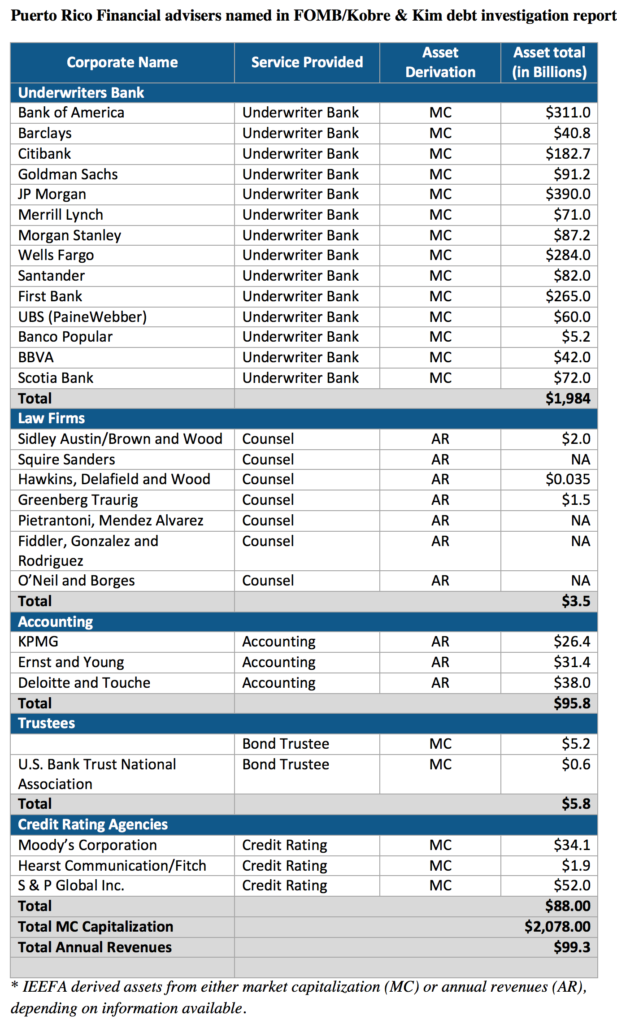

The Special Claims Committee of the Financial Oversight Board for Puerto Rico announced that it and the Official Committee of Unsecured Creditors in Puerto Rico’s debt restructuring have filed an objection to more than $6 billion of Puerto Rico’s bonded debt. The objection asserts that the invalid debt was issued in clear violation of the […]

If the prediction of zero economic growth by 2023 holds true, the deal with COFINA creditors will lead to a new default for Puerto Rico.

Many of these same lawyers, accountants, bankers and credit-rating experts continue to have the ear of the Puerto Rican government.

The report, which is just under 600 pages long, includes the results of its investigation into Puerto Rico’s debt and its connection to the current fiscal crisis.

The Financial Oversight and Management Board for Puerto Rico and the government of Puerto Rico announced they have reached a deal with Senior and Junior bondholders of Sales Tax Financing Corp. credit, as well as monoline insurers.

A mural alongside Baldorioty de Castro Avenue in San Juan, near the exit to De Diego Street, reads nowadays, “¡Auditoría ya, mamabichxs! A ciegas no” (which roughly translates into “Audit Now, suckers! Don’t do it blindly.”)

Puerto Rico had greater financial resources than it previously claimed, but there continues to be little transparency in the process, and audited financial statements still have not been produced since 2014, said Dominic Frederico, CEO of Assured Guaranty Ltd., which holds government debt.

In upcoming years, the term “debt forgiveness” will become a common phrase among individuals, proprietorships, and businesses in Puerto Rico, but not for a good reason.

Before Hurricane María, if Puerto Rico were to pay off its debt without completely choking off economic and social development, it needed a total cancellation of the interest on the public debt and a reduction in the principal of approximately 45 percent to 90 percent. Now, in the wake of the storm, the debt relief needed is much greater.

The Commonwealth of Puerto Rico's second delay in submitting its revised fiscal plan to the Financial Oversight and Management Board for Puerto Rico "underscores the growing economic uncertainties it faces as it continues to recover from Hurricane María," Moody's Investors Service noted in a new report.

National Public Finance Guarantee Corporation announced that it and other creditors have voluntarily dismissed without prejudice the adversary complaint filed on Aug. 7, 2017 which sought to compel the Puerto Rico Electric Power Authority to deposit revenues with the bond trustee as required by the terms of the PREPA Trust Agreement, PROMESA and the U.S. Constitution.

In what could represent the first positive for Puerto Rico in its litigation with creditors and insurance companies over debt repayment, two monoline insurers — National Public Finance Guarantee Corp. and Assured Guaranty withdrew their complaints against the Commonwealth’s Fiscal Plan.

Puerto Rico’s debt service payment could be reduced to zero in the short-term, when the Financial Oversight and Management Board for Puerto Rico modifies the fiscal plan to readjust it to the island’s new panorama following the humanitarian crisis provoked by the passage of a category 4 hurricane through the island.

Hurricane Irma will have negative implications for the Puerto Rico Electric Power Authority’s liquidity and cause further delays to its debt restructuring plans, Moody’s Investors Services predicted in a report released Tuesday.

NIMB ON SOCIAL MEDIA