Oversight Board, creditors’ committee challenge $6B of P.R. debt

The Special Claims Committee of the Financial Oversight Board for Puerto Rico announced that it and the Official Committee of Unsecured Creditors in Puerto Rico’s debt restructuring have filed an objection to more than $6 billion of Puerto Rico’s bonded debt.

The objection asserts that the invalid debt was issued in clear violation of the Puerto Rico Constitution and should be declared null and void.

The Oversight Board and Creditors’ Committee have asked the federal judge who is overseeing Puerto Rico’s restructuring case to declare the Invalid Debt null and void, and to disallow the claims of the Invalid Debt under Title III of PROMESA.

On Sept. 13, 2017, a Special Committee of the Oversight Board retained Kobre & Kim as an independent investigation team to carry out a review of Puerto Rico’s debt and its connection to the current fiscal crisis.

The Special Committee described the investigation as “an integral part of the Board’s mission to restore fiscal balance and economic opportunity and to promote Puerto Rico’s reentry into the capital markets.”

The Special Claims Committee retained Brown Rudnick LLP to assist in this process. The objection is the first major action taken by the Oversight Board as a result of its investigation.

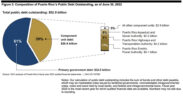

The Oversight Board and Creditors’ Committee identified more than $6 billion of Invalid Debt as exceeding the debt limit in Article VI, section 2 of Puerto Rico’s Constitution.

The Invalid Debt includes all general obligation bonds — bonds backed by the full faith and credit of Puerto Rico — issued by Puerto Rico in 2012 and 2014.

Separately, the Creditors’ Committee also alleges that the invalid debt violates the balanced budget requirement in Article VI, section 7 of the Puerto Rico Constitution, because proceeds of the debt were used to finance deficit spending. The Creditors’ Committee is represented by Paul Hastings LLP as counsel and Zolfo Cooper LLC as its financial advisor.

“The Oversight Board is mindful of the extraordinary responsibility it has been given under PROMESA. As the representatives of Puerto Rico in the Title III restructuring, the Board has the duty to act in the best interests of Puerto Rico and all of its creditors. Challenging improperly issued debt is consistent with that duty,” the entity said in a statement.