Backyard Bondholders Inc. will host its first major forum on June 27 featuring a series of conferences focusing on how Puerto Rico’s fiscal crisis is directly affecting more than 60,000 island residents holding bonds representing some $15 billion in public debt.

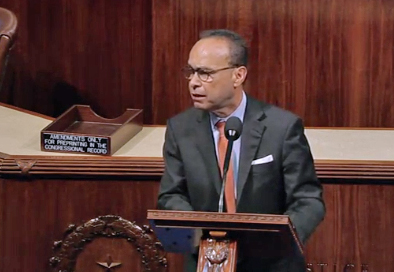

Following an all-day session, the U.S. House passed H.R. 5278, known as the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”) on Thursday, with a bipartisan vote of 297-127 and a number of amendments.

Twenty-five members of Puerto Rico’s credit union sector unveiled today in New York a proposal to restructure the bulk of the government’s outstanding public debt, which calls for reducing the payment burden and providing guarantees to creditors.

After months of negotiation, U.S. House Republicans introduced a bill that would help Puerto Rico deal with its $69 billion debt that has crippled its economy, setting rules that would allow it to seek bankruptcy protection.

An independent commission established by Puerto Rico's government has issued a report casting doubt on the legality of the island's debt, which could be declared null by a court if it decides the Commonwealth borrowed without authorization.

A study by the Mercatus Center at George Mason University released Wednesday showed that on the basis of its fiscal solvency in five separate categories, Puerto Rico ranks 51st among the U.S. states and the island itself for its fiscal health.

If the government of Puerto Rico were to pay the full amount due next year in GO debt would require laying off more than 3,400 public workers, among other adjustments.

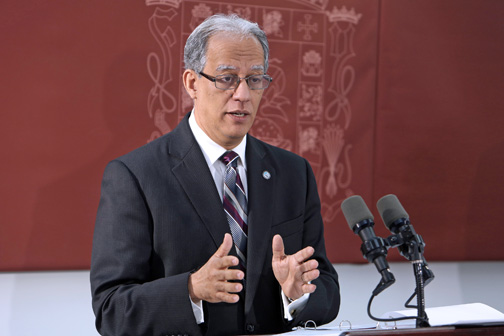

The Puerto Rico Government Development Bank is waiting for creditors to submit a “global” restructuring offer that would address some $48 billion in debt in its entirety, rather than piecemeal, agency President Melba Acosta said during budget hearings Monday.

Puerto Rico Gov. Alejandro García-Padilla on Monday unveiled a proposed budget for Fiscal 2017 of $9.1 billion, down $700 million from the original budget that was approved last year and $192 million less than the adjusted current budget.

The U.S. House of Representatives submitted late Wednesday H.R. 5278, the “Puerto Rico Oversight, Management, and Economic Stability Act,” which includes several revisions to the original bill proposing an oversight board and a debt-restructuring framework for the island.

Backyard Bondholders, a nonprofit organization representing individual Puerto Rico creditors, on Wednesday said it favors the adoption of a fiscal control board to facilitate an orderly debt restructuring process.

While insurers domiciled in Puerto Rico have maintained underwriting discipline and demonstrated favorable operating results and solid balance sheet strength, the competitive operating environment and economic challenges there will hinder their ability to grow over the near to medium term, according to a new A.M. Best briefing.

Puerto Rico Gov. Alejandro García-Padilla and members of the island’s private sector held meetings with key lawmakers in Congress, including U.S. House Speaker Paul Ryan, to discuss the bill that would address the Commonwealth’s fiscal crisis.

Puerto Rico is facing a severe fiscal crisis. Observers agree that the island’s public entities are unable to repay their debts on time and in full, making default and debt restructuring inevitable.

Puerto Rico Gov. Alejandro García-Padilla met with a group of unidentified advisors to the Commonwealth’s creditors to communicate, first hand, the need for Puerto Rico reach a broad restructuring of its $70 billion public debt to sustainable levels, his office said Tuesday.

NIMB ON SOCIAL MEDIA