The Financial Oversight and Management Board for Puerto Rico notified Gov. Ricardo Rosselló and the Legislature that the compliance certification issued by government Aug. 1 regarding the recently passed Act 47, failed to provide the required formal estimate of the law’s fiscal impact.

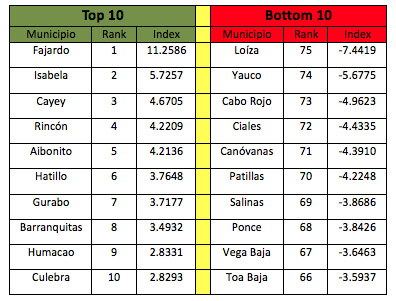

The majority of Puerto Rico’s 78 municipalities are in dire financial conditions, with more than half carrying deficits on their general funds, the Center for Integrity in Public Policy (CIPP) revealed in its third annual Financial Health Index.

During the last few years we have all been at times crushed by that uneasy feeling caused by this extended recession, and more recently by the passage of the Puerto Rico Oversight, Management, and Economic Stability Act ("PROMESA") of 2016, both of which continue to hover over our daily life as an unwelcome guest that has prolonged its visit longer than expected, refusing to leave.

A study by the Mercatus Center at George Mason University released Wednesday showed that on the basis of its fiscal solvency in five separate categories, Puerto Rico ranks 51st among the U.S. states and the island itself for its fiscal health.

Puerto Rico is facing a severe fiscal crisis. Observers agree that the island’s public entities are unable to repay their debts on time and in full, making default and debt restructuring inevitable.

Center for a New Economy representatives on Thursday stressed the urgency for Congressional action, but cautioned that any bill approved in Washington must provide Puerto Rico with a debt restructuring mechanism “that will actually work.”

Puerto Rico Gov. Alejandro García-Padilla announced Tuesday the appointment of Secretary of State Víctor Suárez as executive director and sole member of the Financial Advisory Authority and Fiscal Agency to act as the Commonwealth’s fiscal agent, financial advisor and information agent.

The Center for Integrity and Public Policy (CIPP), a nonprofit that promotes government transparency, open access to data, and greater citizen engagement, unveiled Thursday the Municipal Financial Health Index, a new tool to analyze and compare the financial health of Puerto Rico’s 78 municipalities.

The Puerto Rico central government is facing pressure to “act with more conviction and with more urgency” to address its dwindling liquidity, crushing debt and anxiety building up over the island’s fiscal problems.

Representatives from 20 of Puerto Rico’s largest private-sector organizations expressed their willingness to work with the government’s task force on proposals to restructure the island’s fiscal issues.

The loss of Section 936 tax breaks, combined with overly indulgent local labor laws and a federal policy that encourages people to stay on the dole rather than work, have all contributed to Puerto Rico’s current fiscal nightmare.

During the opening day of its annual convention Thursday, the Puerto Rico Manufacturers Association delivered a list of recommendations — including cutbacks, government restructuring and fiscal measures — to administration officials, in hopes of doing its part to help the island pull out of its economic crisis.

Saying it “is the best option” to solve the government’s fiscal problems, Gov. Alejandro García-Padilla re-introduced Tuesday a proposal to establish a value added tax system he said would generate more than $2.5 billion in net revenue for the cash-strapped administration.

Members of Gov. Alejandro García-Padilla’s fiscal team confirmed Monday the government will likely have to implement cutbacks across the board to address the $441 million deficit it is facing for the start of Fiscal 2016.

Forty years ago, as I prepared for a personal adventure that would change my life forever, I read an autobiography by U.S. Supreme Court Judge William O. Douglas called “Go East Young Man, The Early Years.”

NIMB ON SOCIAL MEDIA