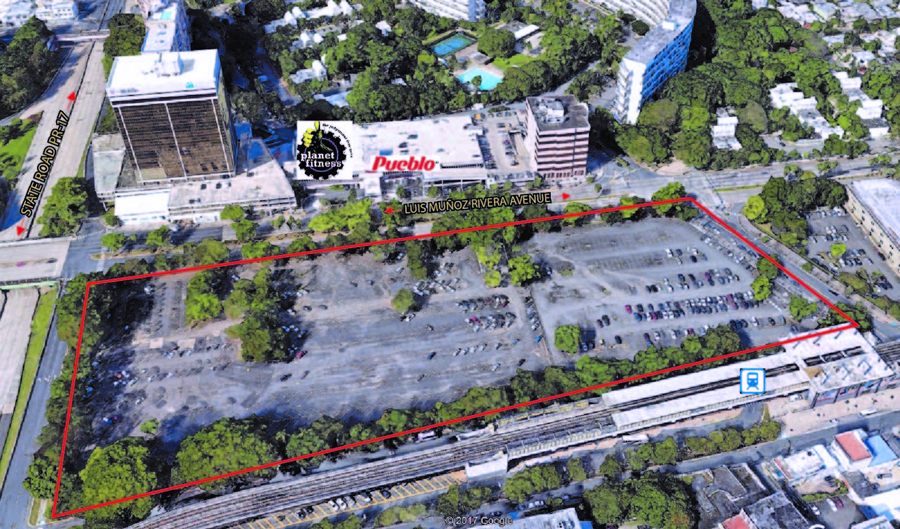

The government of Puerto Rico has sold a commercial lot, known as the “former Sears property” in Hato Rey — held in the defunct Government Development Bank’s portfolio — for $11.6 million.

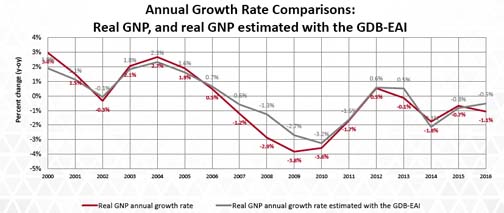

Puerto Rico’s economic activity took a 2.1 percent dive in July 2017, when compared to the same month last year, according to the Economic Activity Index released by the Puerto Rico Fiscal Agency and Financial Advisory Authority and the Government Development Bank.

The Fiscal Agency and Financial Advisory Authority, or AAFAF, updated two requests for qualification (RFQ) for roles related to the Government Development Bank’s restructuring support agreement, which were originally posted on its website Aug. 11.

Gov. Ricardo Rosselló announced Monday that the Puerto Rico Fiscal Agency and Financial Advisory Authority (AAFAF, for its Spanish acronym) and the Government Development Bank of Puerto Rico have entered into a restructuring support agreement (RSA) with a significant portion of its major stakeholders.

Imagine that the Puerto Rico Commission for the Comprehensive Audit of the Public Credit is operating and that it calls for public hearings.

The Commonwealth of Puerto Rico defaulted on $312 million in principal and interest due Feb. 1st by four credit-issuing entities, including constitutionally protected General Obligation bonds, the government confirmed Wednesday.

The fate of the Puerto Rico Government Development Bank should not be liquidation, but rather a refocus to return to promoting growth on the island, Interim President Alberto Bacó said Monday, the day he took on the job of steering the former public fiscal agent.

Economic Development and Commerce Secretary Alberto Bacó will take on an additional role in Gov. Alejandro García-Padilla’s cabinet effective today, when he starts as acting President of the Government Development Bank.

Bonistas del Patio Inc., which groups Puerto Rican bondholders holding about $15 billion in Commonwealth debt, called Gov. Alejandro García-Padilla’s decision to sign a law to restruction the Government Development Bank’s outstanding debt “irresponsible and illegal.”

Saying she “did the best she could with the tough hand that was dealt” and ending 12 years of public service, Puerto Rico Government Development Bank President Melba Acosta is stepping down from her post, effective July 31.

Puerto Rico Government Development Bank bondholders filed a motion to ensure that they may continue to pursue their constitutional challenges to the Puerto Rico Emergency Moratorium and Financial Rehabilitation Act, Law 21 of 2016, known as the “Moratorium Act.”

Following the Puerto Rico government’s confirmation Tuesday that negotiations with Rico Sales Tax Financing Corporation (known as COFINA) and General Obligation bondholders had broken off, both creditor groups went public to defend their positions on the ongoing talks.

The government of Puerto Rico announced Wednesday the launch of an a bondholder registry to improve and facilitate communications with more than 500,000 creditors holding debt issued by the Commonwealth and its public corporations and instrumentalities.

Twenty-five members of Puerto Rico’s credit union sector unveiled today in New York a proposal to restructure the bulk of the government’s outstanding public debt, which calls for reducing the payment burden and providing guarantees to creditors.

The Puerto Rico Government Development Bank is waiting for creditors to submit a “global” restructuring offer that would address some $48 billion in debt in its entirety, rather than piecemeal, agency President Melba Acosta said during budget hearings Monday.

NIMB ON SOCIAL MEDIA