Gov.-elect Alejandro García-Padilla revealed Tuesday the identities of several more members of its economic team, who will take office in January — several of which are already familiar faces in government.

The lack of seriousness and responsibility reflected by the comments made by the president of the Government Development Bank of Puerto Rico are truly disturbing.

Government Development Bank of Puerto Rico President Juan Carlos Batlle recently addressed a group of UBS clients on the outlook for the island’s credit as part of the company’s “UBS Speaker Series” cycle that began earlier this year.

The Puerto Rico government is reviewing a request by one of the island's main hotel operators to restructure the loan that helped pay for the renovation of two landmark hotels: La Concha Renaissance Resort & Casino, currently in operation, and the Condado Vanderbilt Hotel, which shut down 15 years ago and reopens on Tuesday in a phased manner.

Credit ratings agency Standard & Poor’s affirmed Tuesday the “BBB-” rating of the University of Puerto Rico bonds, Series P, Q and O, giving them a stable outlook.

The Economic Development Bank was included Tuesday in the Puerto Rico Development Fund Guarantee Program through an agreement signed with the Government Development Bank, government officials announced.

The Gov. Luis Fortuño administration sent a scathing letter to Moody’s Investor Services late Thursday, expressing its “utter disappointment” with the agency’s decision to downgrade the Puerto Rico Sales and Use Tax Financing Corporation’s bond rating.

The Puerto Rico Government Development Bank is mulling over the possibility of filing a legal claim related to the London Interbank Offered Rate manipulation case, agency President Juan Carlos Batlle told Reuters Monday.

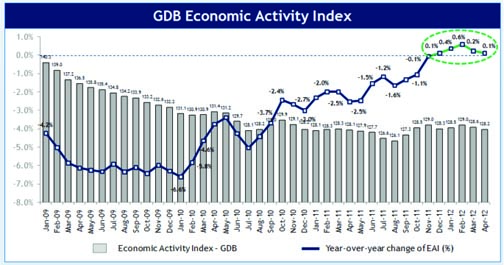

The Government Development Bank’s Economic Activity Index for the month of April reached 128.2 during April 2012, an increase of 0.1 percent when compared to April 2011 and the fifth consecutive month of positive year-over-year growth since recession began in 2006, the agency said Wednesday.

While recognizing that the Gov. Luis Fortuño administration’s financial strides “have been large and comprehensive,” Bank of America Merrill Lynch said in a recent report that Puerto Rico still has challenges ahead before achieving a full recovery.

The Puerto Rico Public Finance Corporation placed and sold $410 million in bonds in the local market, the proceeds of which the agency will use to refinance existing debt and save $6.6 million in interest payments.

In an apparent response to public pressure, the Government Development Bank on Wednesday eliminated the restriction on the information it shared with the public on its website.

The Government Development Bank unveiled the Economic Activity Index for the months of January and February, which reflected an increase of 0.5 percent and 0.7 percent, respectively in comparison to the same months in 2011.

NIMB ON SOCIAL MEDIA