The new administration under Puerto Rico Gov. Ricardo Rosselló on Wednesday released a Request for Qualifications (RFQ), seeking a new strategic advisor and legal counsel to move ahead with restructuring the Commonwealth’s $68 billion debt.

Scientific Games Corp. announced Tuesday it has landed an eight-year contract with the government of Puerto Rico to run the electronic lottery, known as “Lotería Electrónica.”

Gov.-elect Ricardo Rosselló announced Monday the first five members of his cabinet, including his Chief of Staff, chief legal advisor and his representative before the Financial Oversight and Management Board.

The Financial Oversight and Management Board for Puerto Rico opened a call Thursday for individuals and organizations to provide written comments on the government of Puerto Rico’s proposed fiscal plan.

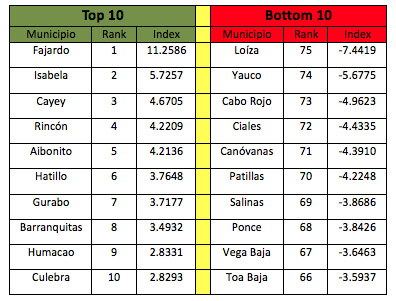

The majority of Puerto Rico’s 78 municipalities are in dire financial conditions, with more than half carrying deficits on their general funds, the Center for Integrity in Public Policy (CIPP) revealed in its third annual Financial Health Index.

The Puerto Rico Association of Automobile Distributors and Dealers released the findings of a study Wednesday that reflected, among other data, that used car sales has been on the rise in the past decade, outpacing new vehicle movement.

Puerto Rico Gov. Alejandro García-Padilla announced Thursday he has turned over several documents detailing the island’s fiscal situation to the fiscal oversight board, a day ahead of the federally appointed body’s first meeting today.

In Puerto Rico’s embattled economy, everyone is at risk. Nonprofit organizations are no exception.

The seven-member Financial Oversight and Management Board for Puerto Rico is expected to meet sometime next week for the first time since being constituted by President Obama to address the island’s economic crisis, Richard Ravitch, who will represent the Commonwealth’s governor in the body, said Monday.

NEW YORK — Puerto Rico Gov. Alejandro García-Padilla confirmed Tuesday that his administration will have a new fiscal plan ready shortly after the federal fiscal oversight board is “appointed and operational.”

Lobbying efforts both for and against the approval of the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) bill at the Senate gained steam in Washington Thursday, with public- and private-sector representatives making their case with U.S. Senators.

The Puerto Rico Government Development Bank is waiting for creditors to submit a “global” restructuring offer that would address some $48 billion in debt in its entirety, rather than piecemeal, agency President Melba Acosta said during budget hearings Monday.

Puerto Rico Gov. Alejandro García-Padilla on Monday unveiled a proposed budget for Fiscal 2017 of $9.1 billion, down $700 million from the original budget that was approved last year and $192 million less than the adjusted current budget.

After nearly a year of litigation, the Center for Investigative Journalism on Thursday confirmed another legal victory in its battle against the Government Development Bank for Puerto Rico to gain access to information about the hedge funds that hold the Commonwealth’s public debt.

Although the government of Puerto Rico paid its General Obligation bonds and guaranteed debt due May 1, which totaled about $103 million, Moody’s Investors Service believes it will enter into an eventual default of these bonds in the absence of a federal stay on litigation.

NIMB ON SOCIAL MEDIA