Prior to the withdrawal, the rating outlook on FirstBank was stable.

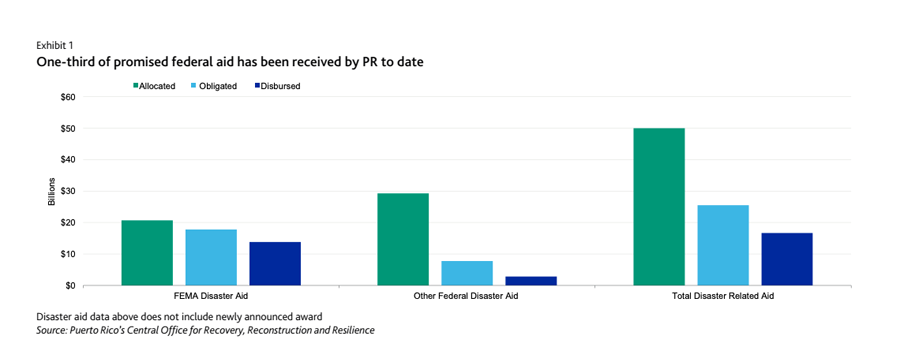

The announcement last week that Puerto Rico will receive almost $13 billion in new disaster aid from the Federal Emergency Management Agency, primarily to rebuild the island’s power grid, is credit positive, Moody’s Investors Service said. “The announcement is credit positive for both Puerto Rico Electric Power Authority (PREPA: Ca, Neg) and the Commonwealth of […]

The almost non-stop sequence of earthquakes that have rattled Puerto Rico for the better part of the last two weeks will “exacerbate the commonwealth’s challenges as it tries to rebuild its economy,” Moody’s Investors Service said in a commentary. “The events highlight the significant environmental risks faced by Puerto Rico and businesses considering investment on […]

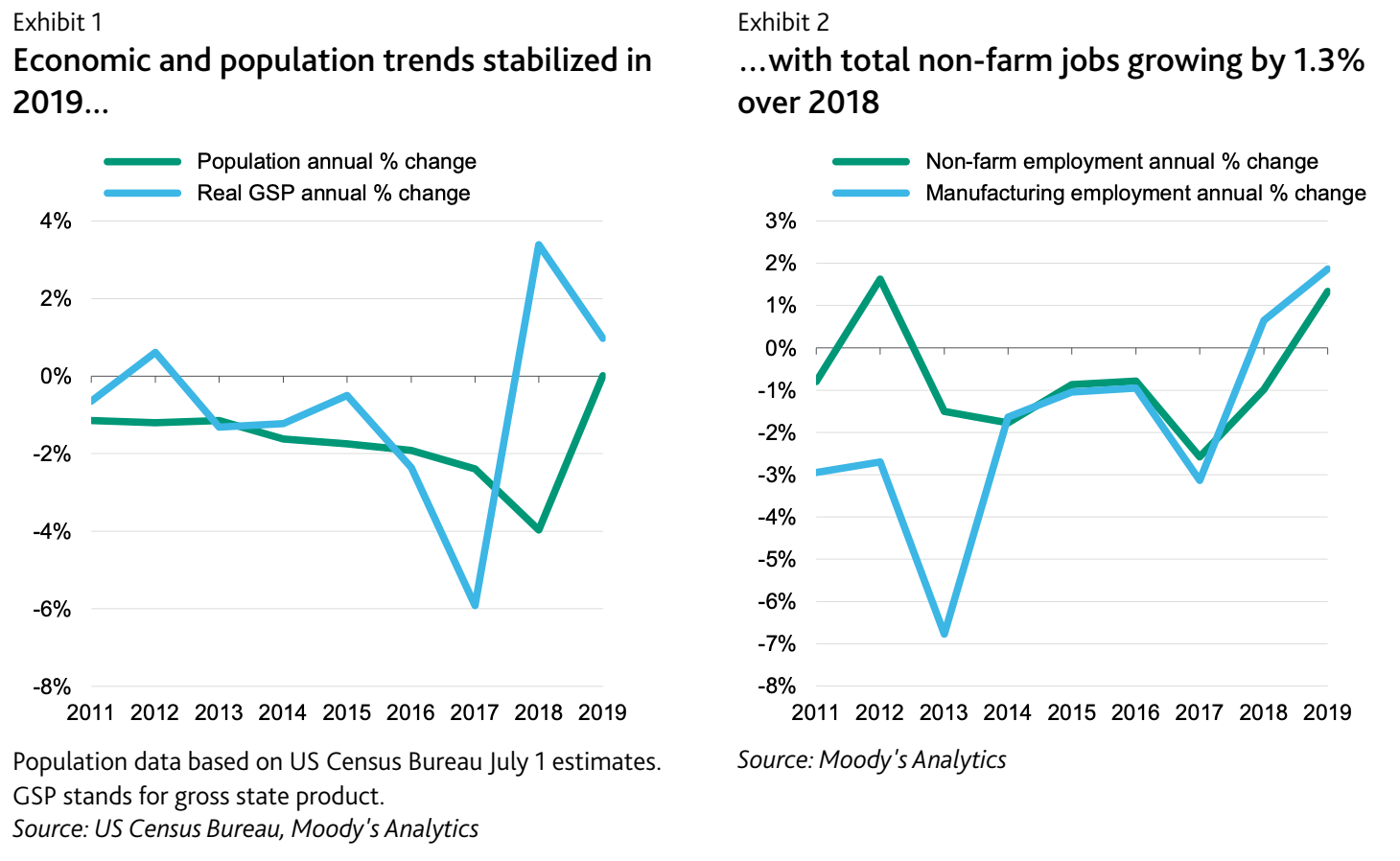

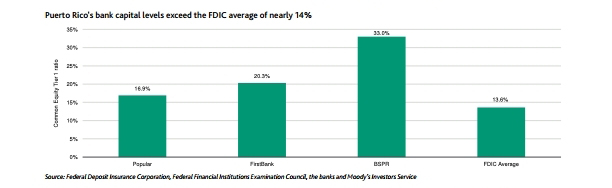

The reason for the positive outlook is that Moody’s believes federal estimates of the island’s Gross Domestic Product “will bolster reforms by the island that should encourage unbanked residents to participate in the banking system, thereby spurring loan growth and increasing operating margins.” In its report, Moody’s predicted that the banks that will benefit are […]

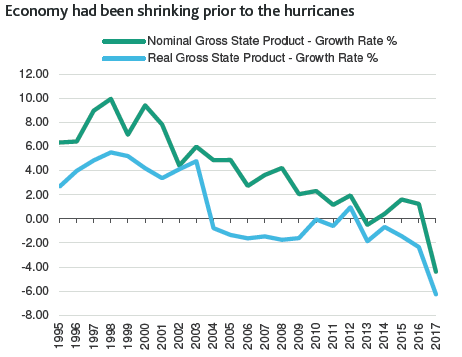

Following a contraction of 6.2 percent in 2017, Moody’s Credit Standards and Strategy Group expects Puerto Rico’s economy to shrink by another 6 percent to 7 percent this year, with some rebound in the second half of the year, supported by rebuilding activity.

Reactions from the public and private sector poured in Thursday on the Revised Fiscal Plans for the government of Puerto Rico, the Puerto Rico Electric Power Authority and the Puerto Rico Aqueduct and Sewer Authority presented to the Financial Oversight and Management Board for Puerto Rico for certification.

The Commonwealth of Puerto Rico's second delay in submitting its revised fiscal plan to the Financial Oversight and Management Board for Puerto Rico "underscores the growing economic uncertainties it faces as it continues to recover from Hurricane María," Moody's Investors Service noted in a new report.

Puerto Rico Electric Power Authority bondholders can expect to recover about 35 percent of their investments due to the business disruption and costs, as well as lost revenues related to damage caused by Hurricanes Irma and María, Moody’s Investors Service predicted in a report released Thursday.

Moody's Investors Service has placed the Ba3 rating on Sacred Heart University’s General Revenue and Refunding Bonds, 2012A on review for downgrade.

The Commonwealth of Puerto Rico is facing new risks and economic uncertainty following the devastation caused by Hurricane Maria last week, Moody’s Investors Service concluded in a report released Tuesday.

Hurricane Irma will have negative implications for the Puerto Rico Electric Power Authority’s liquidity and cause further delays to its debt restructuring plans, Moody’s Investors Services predicted in a report released Tuesday.

Moody’s Investors Service's July 6 downgrade of the Puerto Rico Electric Power Authority’s credit rating to from Caa3 to Ca reflects “the increased uncertainty that now exists regarding the outcome and the timing of a future debt restructuring plan for PREPA, which in the end will lower bondholder recoveries.

The Puerto Rico Electric Power Authority provided additional detail on its previously announced extension and supplement to its restructuring support agreement (RSA) with the ad hoc group of PREPA bondholders, the fuel line lenders, the monoline insurers and the Government Development Bank for Puerto Rico.

NIMB ON SOCIAL MEDIA