House Speaker Jaime Perelló told Treasury Department officials during a hearing Wednesday that they need to “go back to the table” on certain aspects of the proposed tax reform, including the frequency with which consumers will receive rebates to mitigate the impact of the new 16 percent value-added tax structure.

Puerto Rico Gov. Alejandro García-Padilla offered a televised speech Tuesday in which he outlined his proposal for overhauling the island’s current tax system to what he described as a “simpler and fair one.”

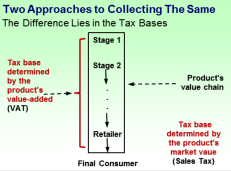

The implementation of a value-added tax system in Puerto Rico to replace the current sales tax structure could have a number of consequences — from uncertainty to high inflation to lower than expected fiscal revenue — that have yet to be publicly discussed, economist firm H. Calero Consulting said in its most recent “Economic Pulse” publication.