As Tax Day 2019 swiftly approaches, numerous entrepreneurs are seeing new benefits from the Tax Cuts & Jobs Act, enabling them to grow their ventures and hire additional staff. I recently co-hosted the White House Manufacturing Roundtable at which about 20 small business owners discussed the resurgence of manufacturing in the chemical, construction, consumer goods, […]

As the April 15 income tax return filing deadline looms, the Puerto Rico Society of CPAs has launched its tax orientation campaign, which this year has extended to digital platforms such as Facebook. “For the first time we use live transmissions via Facebook to receive and answer questions from the public,” said Cecilia C. Columbus […]

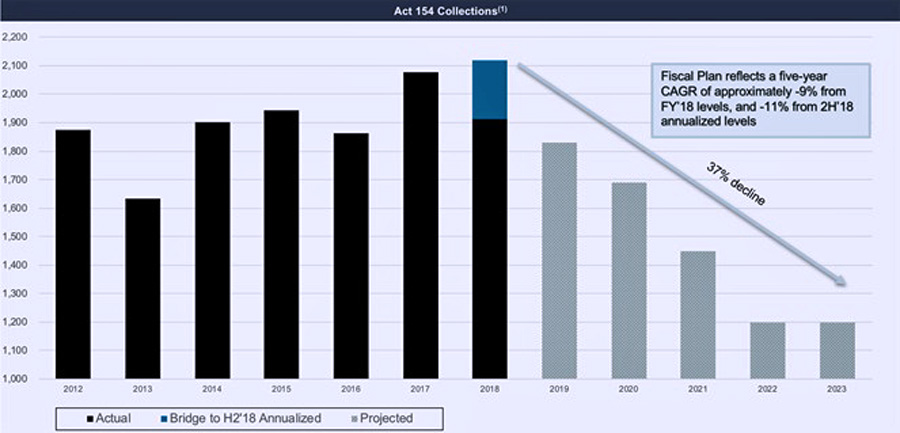

Instead of using the most probable assumptions based on actual past results, the Oversight Board relied on untested assumptions which in combination arrive at extremely low expected revenue numbers for its projections.

Even though our island is facing a severe economic recession that has lasted more than 10 years, and priorities could have changed after the passage of hurricanes Irma and María last year, we can’t procrastinate our responsibility to properly plan for our individual future.

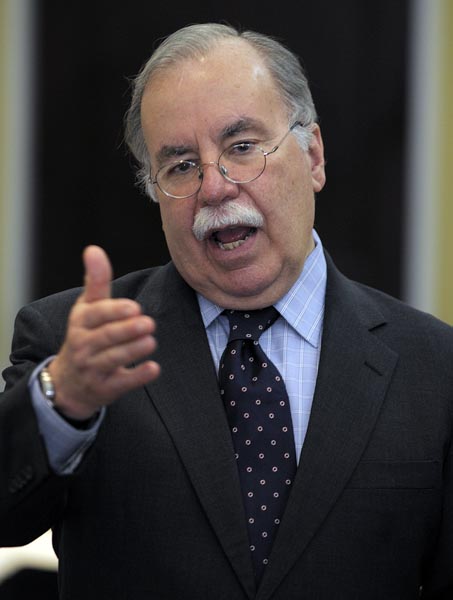

The recently announced tax reform should include measures to encourage locally financed enterprises and contain provisions aimed at creating a level playing field for local businesses, particularly small and medium enterprises, said Rodrigo Masses president of the Puerto Rico Manufacturers Association.

During his second State of the Commonwealth address since taking office, Puerto Rico Gov. Ricardo announced a new tax model to phase out the Business to Business (B2B) and plans to cut the Sales and Use Tax on processed foods from 11.5 percent to 7 percent.

In upcoming years, the term “debt forgiveness” will become a common phrase among individuals, proprietorships, and businesses in Puerto Rico, but not for a good reason.

The Individual Retirement Account is a retirement savings account. However, the funds in an IRA may be used for other purposes in case of an emergency or special need and the Puerto Rico Internal Revenue Code provides for it.

Moving to another country and starting over is one of the most frightening yet exhilarating adventures ever. Life as you know it will change and we are not just talking about addresses and new neighbors.

With ongoing negotiations over tax reform, Members of the Congressional Hispanic Caucus Puerto Rico Taskforce sent a letter to Republican leaders in Congress urging the inclusion of tax provisions that will help rebuild Puerto Rico.

Puerto Rico Gov. Ricardo Rosselló urged Congress to consider Puerto Rico in the federal tax reform and to include the island in the Supplemental Disaster Relief Package that will attend the different natural disasters registered in the nation to ensure equal treatment for American citizens residing on the island.

Of all the atrocious ideas I have heard in the past few years, and there have been plenty, none is more poisonous and counterproductive than the announcement that the Treasury Department is planning to significantly increase taxes to self-employed people.

Puerto Rico government officials and representatives from hospitality company Airbnb signed a tax collection agreement that is expected to generate some $2 million a year for the island’s economy in the form of room taxes, Gov. Ricardo Rosselló announced Thursday.

In Puerto Rico we have focused so much on the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) that we seem to have forgotten that we are part of a much larger economy beyond our 100x35 and that what happens there has an impact on us.

Espacios Abiertos, a nonprofit that seeks to empower society, on Thursday urged the government to provide data on the tax privileges that constitute a considerable amount of the island’s resources, particularly in times of crisis in which austerity measures are perceived due to a shortage of funds in the public coffers.

NIMB ON SOCIAL MEDIA