Law 1 of January 31, 2011, also known as the Internal Revenue Code for a New Puerto Rico (herein the “New Code”), replaces the Internal Revenue Code of 1994, as amended. This New Code amends and adds new provisions to the previously known Section 1165, related to Puerto Rico Pensions Plans (now Section 1081.01). This article specifically refers to Chapter 8 — Trust and Successions, Subchapter A — Employees Trusts.

The Puerto Rico Treasury Department will begin a round of visits to San Juan metropolitan area businesses today to monitoring compliance of the Sales and Use Tax (known as IVU in Spanish).

Puerto Rico Treasury Department collections totaled $665 million in January, a 9 percent, or $67 million, drop from what the government reported during the same month last year, agency Secretary Melba Acosta said Tuesday.

The Puerto Rico Treasury Department announced Wednesday it has begun the task of distributing 2012 tax booklets, putting close to 80,000 of the short forms in the mail in anticipation of this year’s April 15th filing deadline.

Treasury Secretary Juan Carlos Méndez confirmed Wednesday that General Fund collections for FY 2012 ending June 30 reached $8.6 billion, exceeding the government’s goals by $10 million.

Net revenue making its way to the Puerto Rico government’s General Fund exceeded $1.2 billion in April, with personal and corporate income tax collections representing 69 percent, or $830 million of the month’s total, agency Secretary Jesús Méndez said Monday.

Puerto Rico residents will get the chance to save some money on back-to-school purchases during a tax-free weekend July 13-15, Treasury Secretary Jesús F. Méndez said.

Doral Bank has reached a deal with the Treasury Department regarding $200 million in overpaid taxes that the bank will now write off in its books as a prepaid expense.

A deduction on the tax return is allowed for an unforeseen loss of the principal residence of a taxpayer incurred during the taxable year.

The Treasury Department pumped $731 million into the government’s General Fund last month, or $216 million more than what it collected during January 2011. The 42 percent hike was fueled by income and excise taxes, Treasury Secretary Jesús Méndez said Thursday.

About 25 percent more Puerto Rico taxpayers will be able to file the short form this year as the 2010 Tax Reform takes full effect, simplifying many reporting processes that previously required the more complicated long form, Treasury Deputy Secretary Blanca Álvarez-Ramírez told News is my Business.

Net General Fund revenue totaled $776 million in December, representing an increase of $210 million when compared to the same month in 2010. The hike was attributed to a surge in motor vehicle excise tax collections, which Treasury Secretary Jesús Méndez said reflected the highest year-over-year percentage growth.

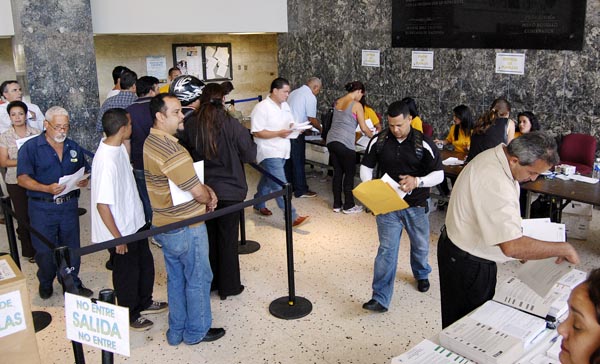

In preparation for this year’s tax season, the Treasury Department announced Tuesday it has already opened six centers throughout the island to orient taxpayers on the terms of the Law to Strengthen Public Health and Safety and the recently granted tax credit for citizens who are 65 or older.

Weekly IVU Loto drawings will offer higher prizes starting Nov. 29, in an effort by the Treasury Department to increase retailer participation rates from the current 33,250, agency chief Jesús Méndez said Monday.

The public and private sectors released sharply contrasting economic productivity reports Thursday that on the one hand claimed an increase in public revenue collections, while on the other denoted a significant contraction in manufacturing sector activity.

NIMB ON SOCIAL MEDIA