The Commonwealth will appeal the decision by U.S. District Judge José A. Fusté invalidating the transfer pricing tax applied to Wal-Mart, Gov. Alejandro García-Padilla said Monday, while blasting the judge for “taking away $100 million” from the people of Puerto Rico.

Puerto Rico’s General Fund revenue collections totaled $767.5 million in February, reflecting a $58.2 million increase compared to February 2015, and $34.1 million above revised estimates.

Filing an individual paper tax return becomes outdated this April as Puerto Rico switches to compulsory electronic filing in a move that is expected to save the Treasury Department up to $5 million in expenses, according to one of its top officials.

Since going into effect last October, the Sales & Use Tax (SUT) on business-to-business (B2B) services has generated $26.4 million, the Puerto Rico Treasury Department reported.

The Puerto Rico Treasury Department has launched a series of embargoes on local businesses that have not been remitting collected Sales and Use Tax (“IVU”, for its Spanish acronym) to the government, nor their employees’ tax retentions.

The offensive launched by the Puerto Rico Treasury Department in November to crack down on retailers that collected sales and use tax revenue, but failed to remit it to the agency has unleashed a string of bankruptcy filings by those businesses, which appear to have turned to the court for protection.

With an estimated $700 million in the Government Development Bank’s coffers and a Treasury Department that reported $488.6 million in revenue collections in November, Gov. Alejandro García-Padilla announced Sunday public sector employees will receive their Christmas bonuses, as established by law.

Puerto Rico General Fund collections reached $488.6 million in November, falling $15.4 million short of estimates, but $36.7 million above what the government shored up during the same month in 2014, Treasury Secretary Juan Zaragoza said Monday.

Microsoft Corp. could be close to landing a contract to implement a unified accounting system across Puerto Rico government agencies, which currently are unable to share data with each other, making reporting a challenge.

General Fund net revenues for September totaled $758 million, representing an increase of $50.3 million, or 7.1 percent, year-over-year, but $17.4 million below estimates, Treasury Secretary Juan Zaragoza-Gómez said Thursday upon revealing the results.

The Puerto Rico Treasury Department revealed Monday that it shored up more than $1.3 billion in revenue for the government, but admitted it fell short by $97 million compared to estimates.

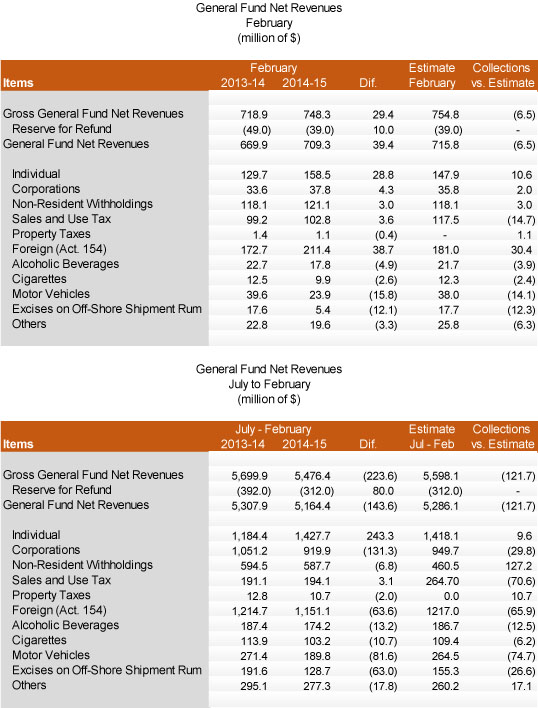

The Puerto Rico Treasury Department collected $709.3 million in February for the General Fund, a figure that was up $39.4 million, or 5.9 percent when compared to the same month last year, and $6.5 million, or 0.9 percent, below estimates.

Doral Bank was on the receiving end of major blows by the Federal Deposit Insurance Corp. and the Appellate Court Wednesday, just before it's time as a member of Puerto Rico’s financial community could come to an end.

Gov. Alejandro García-Padilla announced Wednesday the restructuring of the Puerto Rico Treasury Department, as well as offered details of the administration’s proposed tax reform expounded in a 1,400-page bill submitted at the Legislature late in the day.

The tax overhaul currently being discussed at the highest levels of government, based on an analysis by KPMG Accounting Services, would shore up as much as $6 billion a year for the public coffers, based on the application of a new 16 percent goods and services tax, according to the report released Wednesday.

NIMB ON SOCIAL MEDIA