The Puerto Rico Treasury Department announced Tuesday it has submitted the Commonwealth’s audited financial statements for the fiscal year 2012-2013 that ended June 30, 2013.

Popular Inc. announced Thursday it has agreed to sell $450 million of its senior notes, due in 2019, to pay off its Troubled Asset Relief Program debt with the U.S. Treasury.

Doral Financial Corporation filed papers Wednesday appealing a decision by the Superior Court and asking the Puerto Rico Supreme Court to assume jurisdiction of the appeal.

Nearly six years after receiving $935 million from the U.S. Treasury through its Troubled Asset Relief Program, Popular Inc. announced Wednesday it has received the go-ahead from regulators to repay the amount.

The Office of the Commissioner of Financial Institutions, Puerto Rico’s banking watchdog, was left out of the talks leading to the agreement through which the Treasury Department approved a $229 million tax refund to Doral Financial Corp., the regulator said Tuesday during a House public hearing.

Puerto Rico Treasury Secretary Melba Acosta-Febo said today that preliminary General Fund revenue collections for May totaled $753 million, exceeding collections for the same month of last year by $141 million, or 23 percent, and beating estimates by $29 million.

The Puerto Rico Treasury Department has pushed back the start of collections of Sales and Use Tax (known as IVU in Spanish) for merchandise coming through the island’s ports by a month, to Aug. 1, agency officials said Monday.

Doral Financial Corp. filed a lawsuit at the San Juan Superior Court and a Writ for Certification in the Puerto Rico Supreme Court, alleging that the government illegally nullified its agreement to refund the bank nearly $230 million in tax overpayments.

Economist and former Clinton administration official Robert Shapiro said Tuesday the Treasury Department’s decision to nullify an agreement that would have granted Doral Financial Corp. a $230 million tax refund has “serious implications” on the potential to attract future investments, as well as on the island’s economic growth.

Doral Financial Corp. has hired a couple of Washington, D.C-based firms to back up its fight against the Puerto Rico government’s decision to rescind on an agreement signed in 2012 granting the bank a $230 million tax refund.

Following a “deep analysis,” the Puerto Rico Treasury Department denied Doral Financial Corp.’s request for a refund of $230 million it claims to have overpaid in taxes, voiding an agreement struck in March 2012.

The problems at Doral Financial Corp. continued Tuesday, when it informed the Securities and Exchange Commission that it will be unable to file its first quarter results report for the period ended Mar. 31 this week, a day after the deadline passed.

Financially troubled Doral Financial Corp. fired off a letter to the Puerto Rico Treasury Department late last week asking the agency to comply with the terms of a closing agreement reached in 2012 obligating the government to refund the bank for tax over-payments estimated at about $232 million.

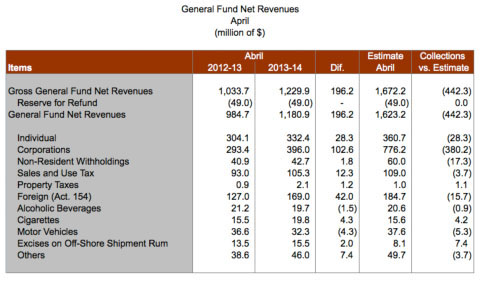

Puerto Rico’s revenue collections for the month of April fell significantly below estimates, short by $442.3 million at $1.18 billion, but up by $196 million year-over-year, the Treasury Department said in a release distributed after the end of business Friday.

NIMB ON SOCIAL MEDIA