The Puerto Rico Treasury Department announced Wednesday it has cut $147.2 million in tax refunds corresponding to 247,744 tax returns during the current tax cycle, representing $80 million more than what was disbursed at this time last year.

The Puerto Rico Treasury Department announced Sunday it will be offering extended hours at its nine tax orientation and preparation centers and 18 collections centers islandwide on Monday and Tuesday, thus wrapping up this year’s tax season.

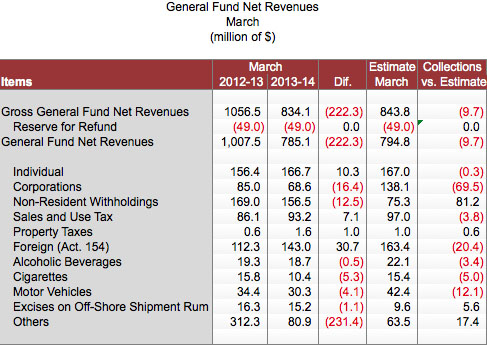

General Fund collections for the month of March totaled $785 million, down 9.7 percent when compared to the $1 billion on record for March 2013.

Thirty-two businesses operating in the upscale Palmas del Mar community in Humacao are facing a collective $373,000 in fines for failing to remit sales and use tax (known as IVU in Spanish) payments to the agency.

The Puerto Rico Treasury Department is kicking this year’s tax season into high gear this week, when it will begin cutting tax refund checks and will open eight tax return orientation and preparation centers today, agency officials said.

As part of the government’s strategies to increase tax evasion oversight, Puerto Rico Gov. Alejandro García-Padilla sent a bill to the Legislature that will allow the use of certified payment processors in all local businesses, as well as the exchange of information between municipalities and the Treasury Department.

Puerto Rico Treasury Secretary Melba Acosta-Febo said Tuesday that preliminary General Fund net revenues for February totaled $670 million, exceeding estimated collections by $57 million.

Puerto Rico Gov. Alejandro García-Padilla signed Tuesday legislation authorizing the issuance of $3.5 billion in general obligation (GO) bonds to be used to refinance outstanding credit lines granted by the Government Development Bank and address the government’s liquidity issues.

The Puerto Rico government is paving the way for a general obligation bond sale next month through which it seeks to raise as much as $3.5 billion to improve the Government Development Bank’s liquidity, high-ranking administration officials said Tuesday.

Two executives who own the Bora Bora and Flamers retail establishments are facing 36 counts of tax evasion and illegal appropriation of public funds for failing to remit more than $1.2 million in sales and use tax money collected between 2009 and 2012, according to the findings of a joint investigation by the Puerto Rico Justice and Treasury Departments.

The Puerto Rico Treasury Department has assigned 20 agents to find and fine businesses in the towns of Carolina and Trujillo Alto who have failed to remit sales and use tax money, as required by law.

Puerto Rico’s General Fund revenue collections for the month of January amounted to $664 million, a figure that is $1 million less than the same period last fiscal year, but that Treasury Secretary Melba Acosta described as a “record.”

More than a year after warning about the possibility, Standard & Poor's Ratings Services on Tuesday made good on its word and cut its rating of Puerto Rico’s general obligation debt to 'BB+' from 'BBB-,' pushing it to the highest junk level status.

Puerto Rico Treasury Secretary Melba Acosta-Febo said Monday that the General Fund collected $925 million in net revenues during December 2013, $12 million higher than the preliminary figure announced in early January.

The Puerto Rico Treasury Department will start mailing out today more than 990,000 single, unified tax form that will standardize the reporting process corresponding to the 2013 taxable year.

NIMB ON SOCIAL MEDIA