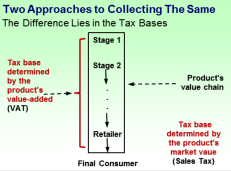

House Finance Committee Chair Rafael “Tatito” Hernández proposed Tuesday the full elimination of the value-added tax slated to go into effect on June 1, while unveiling a package of measures that would essentially “re-reform” Puerto Rico’s tax structure to provide balance.

Saying it “is the best option” to solve the government’s fiscal problems, Gov. Alejandro García-Padilla re-introduced Tuesday a proposal to establish a value added tax system he said would generate more than $2.5 billion in net revenue for the cash-strapped administration.

Saying that it "is a serious attempt to carry out a comprehensive change of the tax system,” the Center for a New Economy suggested during public hearings Wednesday that the reform should be put off until Puerto Rico’s adverse fiscal conditions improve.

The Puerto Rico Hotel and Tourism Association blasted the Tourism Co.’s stand on the proposed value-added tax structure the government is proposing as part of a comprehensive tax reform, saying the agency should “evaluate all aspects that will affect the hospitality industry.”

Your speech hurts. Your government strategy hurts. Your tax reform hurts.

The implementation of a value-added tax system in Puerto Rico to replace the current sales tax structure could have a number of consequences — from uncertainty to high inflation to lower than expected fiscal revenue — that have yet to be publicly discussed, economist firm H. Calero Consulting said in its most recent “Economic Pulse” publication.

NIMB ON SOCIAL MEDIA