OBoard to probe PR debt via independent investigator

The Financial Oversight and Management Board for Puerto Rico announced Wednesday its intention to start a “comprehensive investigation of Puerto Rico’s debt and its relationship to the fiscal crisis.”

For that purpose, it will hire an independent investigator, Oversight Board Executive Director Natalie Jaresko said.

“As we develop the parameters of the investigation and progress in the appointment of the independent investigator, we will be providing more information,” said Oversight Board Executive Director Natalie Jaresko.

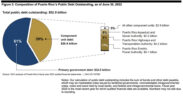

For now, the Board confirmed the investigation will include a review of the fiscal crisis and its contributors, and an examination of Puerto Rico’s estimated $73 billion public debt and its issuance, including disclosure and selling practices.

The process will be consistent with procedures contained in the Puerto Rico Oversight, Management and Economic Stability Act. The Oversight Board will conduct this investigation pursuant to the authority granted to it by Congress and the President under PROMESA, the federally appointed body said.

“The Oversight Board has been specifically given the authority by Congress under PROMESA to conduct an investigation into Puerto Rico’s debt and its connection to the current fiscal crisis,” the Board said in a statement.

“The Oversight Board considers this investigation an integral part of its mission to restore fiscal balance and economic opportunity and to promote Puerto Rico’s reentry to the capital markets pursuant to its responsibilities under PROMESA,” it further stated.

The body will seek to form a special committee of the Oversight Board to appoint an independent investigator to carry out the investigation. The Oversight Board will make its findings public, it said in the same statement.

The Oversight Board is gearing up to hold its ninth public meeting Friday, when it will discuss — among other things — the certification of the proposed fiscal plan for the Public Corporation for the Supervision and Deposit Insurance of Puerto Rico Cooperatives (known as COSSEC in Spanish), pension reform and rightsizing measures in Commonwealth’s Fiscal Plan.

Revitalization coordinator: At least 1 ‘critical’ project by year’s end

Meanwhile, Noel Zamot, the Oversight Board’s revitalization coordinator, confirmed Wednesday that by year’s end, there will be at least one critical infrastructure project underway through Title V of PROMESA.

That mandate is based on the strength of the partnership between local and federal government agencies and private investors to support critically needed economic growth in Puerto Rico.

While Zamot did not reveal specifics, he did say the critical project would likely be infrastructure related to either the island’s aqueduct or energy systems.

In his role, which he assumed a little more than a week ago, Zamot will work closely with the government’s Public-Private Partnerships Administration, headed by Omar Marrero, with whom he met this week.

“One of the things we concluded was that the two processes — revitalization and P3s — are parallel and we can work jointly on identifying projects. The P3 process is very transparent and effective,” he said. “We realized there are certain projects already that need to move forward.”

During his first meeting with members of the media, Zamot said he has fielded calls from would-be investors interested in jumping into the development phase.

“There’s no reason why Puerto Rico can not become the leader in Latin America in infrastructure projects that create jobs, respect and project the environment,” Zamot said. “If we achieve that, we’re in a tremendous position to grow the economy and develop P3s.”

However, he was clear in saying that the plan to develop critical projects will happen without federal funding, other than grants that may be assigned for transportation and other areas.

“Our plan right now is to run this process with that limitation, under the expectation that we won’t have access to financial markets and we’re not necessarily going to get any money from the federal government,” Zamot said. “It makes it difficult, but not impossible because we can demonstrate to investors that we have the right structure in place.”

At present, he is also overseeing the development of a dedicated website to inform investors of project ideas and concepts, “making sure it’s a one-stop-shop so that we don’t miss out on any opportunities.”

The website should also be ready by year’s end.