Op-Ed: Myths and truths on Puerto Rico’s current cycle

Puerto Rico’s “Great Recession,” as is the case with any complex phenomena, is not without its own myths. For example, the prevailing wisdom is that those with college degrees have driven the recent loss of population in Puerto Rico or that U.S. economic growth will somehow induce growth at home. Moreover, a careful look at the evidence shows that our traditional economic thinking is simply no longer applicable to the island’s current economic reality.

Puerto Rico’s “Great Recession,” as is the case with any complex phenomena, is not without its own myths. For example, the prevailing wisdom is that those with college degrees have driven the recent loss of population in Puerto Rico or that U.S. economic growth will somehow induce growth at home. Moreover, a careful look at the evidence shows that our traditional economic thinking is simply no longer applicable to the island’s current economic reality.

We aim to counter several of the myths regarding Puerto Rico’s present cycle, many of which have even created media headlines. We also seek to provide a fresh look into once firmly rooted economic orthodoxy and offer some insight as to the relevance of such rationale for our present troubles. Now, more than ever, an honest and careful examination of our economy’s current economic fundamentals is needed if we want to permanently reverse our current course.

Is Puerto Rico experiencing a brain drain?

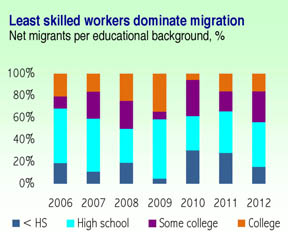

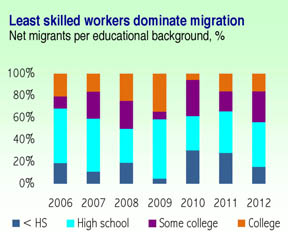

The contraction in the island’s resident population (-4.5 percent since 2006) has led many to assume that a brain drain has also been underway. That is, that the current cycle has led large sections of highly educated and skilled workers to move away from the island. A recent report by the New York Federal Reserve has inquired about this notion, highly controversial in policy circles, by taking a closer look at data from the annual Census and Community Surveys. In fact, 60 percent of net migrants during 2006-2012 had an average of, at most, high school education.

The reason for the misperception, however, is understandable. A closer look at migration patterns for the college educated shows that, up to 2009, the cohort did contribute significantly to net migration (2009 was particularly bad since it captured 39 percent of total net migration). This coincided with the year in which uncertainty in Puerto Rico peaked with the months-long strike at the University of Puerto Rico and a general strike against Law 7.

The fact that a large number of net migrants have at most high school educated will in fact lead to the opposite of a brain drain. Since 2010, the average share of net migrants with at least some college education has averaged at round 13 percent, suggesting that the labor market is increasing its concentration of skilled workers. This can only bode well for the prospects of reconstructing Puerto Rico’s economic landscape.

Is Puerto Rico a regional economy of the U.S.?

Is Puerto Rico a regional economy of the U.S.?

Traditional wisdom has always suggested that historical links between both jurisdictions meant that recessions in the U.S. tended to induce similar dynamics in Puerto Rico. The correlation index between growths rates proves this. In fact, during 1996-2013, the correlation was significantly higher than in the previous 15 years (0.82 and 0.47, respectively).

The island’s current cycle, however, has been both longer and deeper that the one experienced in the U.S., which ended in the third quarter of 2009. For a regional economy, however, the key concept is that of causality, that is, whether the larger economy can affect the dynamics of the smaller economy. If evidence emerges that causality is no longer in place then the regional link is also lost. The issue can be examined through several approaches, such as, cointegration, which focuses on the long-run relationship between U.S. GDP growth and Puerto Rico GNP growth.

Under this method, negative values (particularly beyond -2) suggest the existence of causality while positive values point to the opposite and, thus, to the possibility that the regional link has been lost. In this case, there are clear indications of an increasing decoupling of the U.S. and Puerto Rico economies since the repeal of Section 936. The drawdown in both transfer pricing and U.S. investment in the island has transformed the historical relationship into one where the U.S. is just the supplier of final consumer goods.

Puerto Rico rebuilds with new businesses

Conventional business cycle thinking suggests that a contraction is followed by a recovery that returns the economy to its original steady state, thus following a “V” like shape trajectory. If true, then economic activity would have to return to its original equilibrium. It appears Puerto Rico’s current cycle is likely to continue drifting away from its original form. A shift-share analysis of Puerto Rico’s labor market examines this possibility.

Basically, if the economy returns to equilibrium then the correlation between labor sector shares at the beginning of the cycle and those at the end of the cycle must be close to one. If, on the other hand, the correlation index declines, then, it reflects a change in the structure of production, i.e. the economy is not returning to equilibrium.

The structural change becomes very pronounced after 2006 when Section 936 was fully repealed. The hypothesis is that, rather than going through a traditional business cycle, the current process has been supporting the emergence of a new steady state since 1995 when the correlation index began to decline. This emerging equilibrium is dominated by non-traditional economic activities, mostly undertaken by small and medium enterprises. Thus, the recession did not induce the transformation but rather strengthened it.

Puerto Rico’s labor concentration index, i.e. Herfindahl-Hirschman Index, provides further evidence of structural change. A high HHI suggests larger concentrations of labor in certain industries. In particular, the concentration in manufacturing and construction kept the HHI index hovering at around 20 percent in the early 1990s. Since 2006, however, the HHI has not stopped declining as the pace of structural transformation shifted gears, which has led to a realignment of employment throughout the economy.

Growth will still boost jobs

Orthodox thinking suggests that economic growth translates into job gains once clear signs of a sustainable expansion become evident to employers. This has also been the case in Puerto Rico, although at an increasingly slower pace.

Indeed, employment has become less responsive to GDP over the last decade. Up to 1997, the difference in yearly average growth between GNP and employment was just 0.04 percent, soaring to 0.7 percent, thereafter.

Moreover, the time elasticity of employment-GNP indicates how fast employment would recover if the economy expanded, with values below 1 denoting a less than proportional response to expansions in GNP. From 2003–2009, the situation deteriorated significantly, with the average elasticity going from 1.20 during 1992-2002 to 0.60. Thereafter, to the present, there has been a marginal recovery in jobs vis a vis the official GNP growth figures.

As a result of enormous differences in prospects between the U.S. and Puerto Rico’s labor market, coupled with a federally financed guaranteed safety net, the unemployed have opted in growing numbers since 2003 for a simple quick-exit solution that continues to fuel the job market’s sluggishness.

Jobs are the missing link

Since 2010, long-term unemployment has become the new norm with an average loss of 606 monthly non-farm jobs while, at the same time, inflation has remained low (0.1 percent monthly average from January 2010 to October 2014). Hence, contrary to standard economic thinking, long-term unemployment has remained high under deflationary conditions.

Unemployment typically increases as inflation declines in response to contractions in jobs and consumption (and vice-versa). Over the past four years, Puerto Rico’s long-term unemployed have opted instead to migrate or remain outside the labor force rather than look for work, mostly available only at or around minimum wage. As a result, consumption remains depressed — leading to low inflation — with little possibility of lowering nominal wages enough to create new jobs.

The future is in our hands

The origin of Puerto Rico’s longer term emerging challenges lies in its fading past. Federal transfers in place since before Operation Bootstrap created a developmental and technological “lock-in” that is beginning to wither. The model used indirect subsidies, mostly in the form of foregone revenue, to attract foreign investment.

Federal transfers also financed construction and consumption for decades and, as a result, once the institutional framework that created the lock-in was abandoned, the harsh realities of the local economy surfaced. Development gaps marked by high energy costs, a slow churning bureaucracy, labor rigidities and growing disincentives to work gained top billing.

The island’s economic transformation is now being driven from within, toward a yet-to-materialize equilibrium, through an open-ended structural transformation. It is, in a way, the best time to be creative, as the economy will inevitably reward winners and losers based purely on economic merit. The government’s role will have to evolve to facilitate change rather than be the maker of change.

At a time of limited access to credit markets, available financial resources should be used to close some of the existing gaps. Both the government and the private sector should also acknowledge that the shift in the island’s economic paradigm is here to stay. Not doing it risks repeating past mistakes and, worst of all, continue to fuel the current spiral, a scenario no one wants.

NADA USTED HACE O ESCRIBES EN INGLES O ESPANOL AYUDA LA ECONOMIA O LA GENTE DE PUERTO RICO === NOTHING YOU DO OR WRITE IN ENGLISH OR SPANISH HELPS THE ECONOMY OR THE PEOPLE OF PUERTO RICO.

Compartido por === Shared by

Robert Davis, Coordinador

Proyecto Camara De Comercio Naguabo Ceiba Roosevelt Roads === Roosevelt Roads Ceiba Naguabo Chamber of Commerce Project