2 major Spanish banks doing business in P.R. ace European ‘stress test’

Two major Spanish banks with long-standing presence in Puerto Rico passed the European Banking Authority’s 2011 stress test of institutions in 21 countries, to assess their resilience against the current economic scenario.

Both BBVA and Santander demonstrated their solvency and capital strength during the test failed by eight European financial institutions, according to the results the agency released late last week.

BBVA, which will reportedly achieve a 9.2 percent Tier 1 capital core ratio even in the harshest conditions next year, walked away as “the strongest and soundest bank” among its peers in Europe, fueled by its prudent risk policy and its adoption of technology and innovation, company officials said.

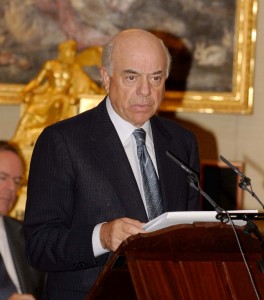

“BBVA is one of the soundest banks in the world,” said BBVA Chairman Francisco González. “We have obtained an outstanding result in the stress tests and that is due to three factors: our presence in more than 30 countries, our prudent risk management policy and our clear vision both in innovation and technology.”

BBVA began doing business on the island in 1967 in Mayagüez. At the time, a group of entrepreneurs founded Banco de Mayagüez, which after several name changes and mergers, became part of Banco Bilbao Vizcaya’s assets in 1988. The bank’s headquarters were moved from Mayagüez to San Juan in 1992, when the BBV Puerto Rico name was adopted. In October 1999 Spain announced the merger of BBV and Argentaria Bank, constituting Banco Bilbao Vizcaya Argentaria, SA (BBVA). BBV Puerto Rico changed its name to Banco Bilbao Vizcaya Argentaria Puerto Rico. At present, BBVA has 36 branches and more than 1,000 employees.

“BBVA Puerto Rico is part of one of the largest financial groups in the world that has demonstrated its strength and good management,” said Rafael Varela, president of BBVA Puerto Rico. “With the results of these tests it is confirmed that Grupo BBVA is the most solid and solvent bank among Europe’s large financial institutions.”

Among other findings, the EBA’s stress test showed that BBVA’s capital strength exceeds that of its European competitors both in the adverse scenario for 2012 and after including mitigating measures. The test also demonstrated BBVA’s capacity to generate profit and pay dividends amid extreme conditions.

“After taking into account the early conversion of €2 billion in mandatory convertible bonds issued by BBVA in 2009 and the use of generic provisions, the core capital ratio would rise even further to 10.2 percent,” BBVA officials said, commenting on the EBA’s results. “This is more than double the pass level required by the tests. Last month BBVA’s board of directors decided to carry out this conversion earlier than planned in an operation that took place today.”

As for Santander, the EBA test showed that it would end 2012 with a Core Tier 1 ratio of 8.4 percent in the most extreme stress scenario, well above the minimum acceptable level. The Core Tier 1 ratio would stand at 8.9 percent including generic provisions.

Even under the most extreme macroeconomic scenario in Spain and in the countries where the group operates and under the most conservative business hypothesis, Santander is capable, without public support, of generating profit, improving its solvency ratios and maintaining its payout ratio at about 50 percent, the stress also showed.

“The stress test confirms the success of Santander’s business model, which focuses on commercial banking, capital strength and prudent risk management, with strong diversification in terms of geographies, businesses and customers,” said Chairman Emilio Botín.

BBVA and Santander weathered the island’s banking meltdown that peaked last year with the closing of three banks.