2,800 Puerto Rican small businesses split $125M in gov’t funds

Some 2,800 small businesses in Puerto Rico received a total of $125 million in grants to under the Community Development Block Grant Disaster Recovery (CBDG-DR) program of the US Department of Housing, local government officials said to mark the end of the Small Business Finance (SBF) program.

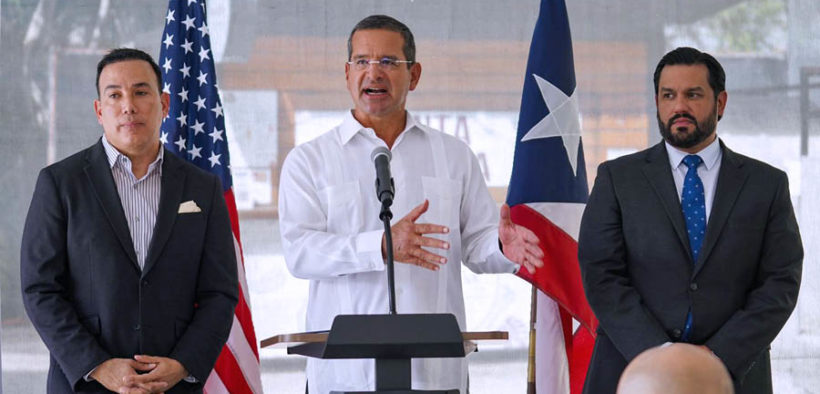

“Today is another day in which, as a government, we highlight our support for the development and growth of our small businesses that are the backbone of the Puerto Rican economy,” Gov. Pedro Pierluisi said. “Amid the historic challenges we have experienced in recent years, our local entrepreneurs have shown great strength and resilience.”

The Puerto Rico Economic Development Bank (BDE, in Spanish), as a sub-recipient of the CDBG-DR funds, ran the SBF program.

The program kicked off with an allocation of up to $50,000 and was increased to $150,000, to maximize assistance to small businesses with 75 employees or less that suffered “damages or financial losses from Hurricane María.”

The funds allocated to the SBF program were released in 2020, and about $12 million were allocated throughout that year.

“Today we have already been able to deliver grants totaling $125 million to nearly 2,800 small businesses in Puerto Rico,” the governor said.

“With these funds we have achieved a significant impact on the small and medium-sized enterprises (SMEs) ecosystem on the island, retaining jobs, creating new opportunities and saving multiple businesses that would have closed permanently if it were not for this aid,” he said.

Meanwhile, the BDE President Luis Alemañy explained that the SBF program kicked off in Puerto Rico on March 2020.

“The first grant of $50,000 under this program was delivered on June 30, 2020, to Cristina Sumaza, owner of Lote 23, a space that houses a gastronomic space in Santurce, right where we return today to celebrate that this federal grant is in the hands of hundreds of small and medium businesses,” Alemañy said.

He noted that the SBF program granted up to $150,000 for operational capital, inventory, rent or mortgage, payroll, utilities, or equipment for those companies that suffered losses after the passage of the 2017 hurricanes.

“After that initial phase of the recovery grant, the SBF program then offered them the opportunity to apply for flexible loans to further promote their economic recovery,” Alemañy added.

The BDE is responsible for managing all major aspects of the program, such as conducting CDBG-DR compliance assessments and evaluating applications and eligibility assessments, implementing financial management and compliance reports, among others.

For his part, Puerto Rico Housing Department Secretary William Rodríguez said as defined by the CDBG-DR program, microenterprises are those companies that have five or fewer employees, which includes their owner or owners.

In addition, small businesses are defined as enterprises with 75 employees or less.

“As part of the requirements, applicants submitted evidence of damage or disruption to their business amid the 2017 hurricanes, as well as an unmet need for recovery and growth, or an unmet need for low- or moderate-income job creation and retention,” Rodríguez said.