CARICOM envoys vow to take rum complaints to WTO

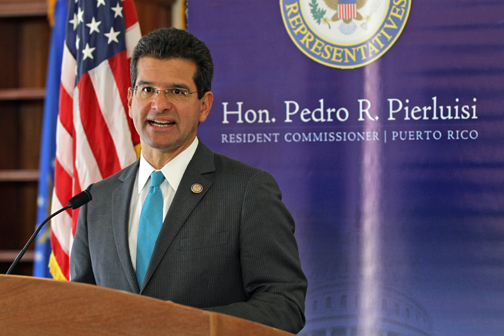

At the heart of the issue is the $13.50 excise tax per gallon charged by the U.S. government on all rum produced in or imported to the United States. (Credit: Larry Luxner)

Editor’s Note: This is the first of a three-part series News is my Business will publish this week on the escalating rum tax debate.

WASHINGTON — Diplomats representing the 15-member Caribbean Community have begun a public lobbying campaign against the use of federal excise-tax rebates by Puerto Rico and the U.S. Virgin Islands to subsidize rum production.

The obscure issue — replete with arcane terms like rebate caps, cover-overs and zero-sum incentives — has galvanized the Washington-based ambassadors of all 15 Caricom nations like never before. Together, they’ve gone up to Capitol Hill, pleaded their case with the administration, and brainstormed on ways to get U.S. policymakers to pay attention to an issue that means big business for their small island states.

These countries, ranging in size from tiny St. Kitts and Nevis (population 53,000) to Haiti (population 10.2 million), accuse the United States of violating World Trade Organization rules by essentially subsidizing domestic rum production. And they threaten to pool their collective clout and take their case to Geneva if the situation is not resolved to their satisfaction.

“We have had four legal opinions, and it is quite clear that while there may be different approaches, the WTO would probably rule in our favor,” said John Beale, the ambassador from Barbados. His is one of the countries most affected by U.S. subsidies, since 90 percent of rum produced in Barbados is exported, either in bulk or bottled form.

At the heart of the issue is the $13.50 excise tax per gallon charged by the U.S. government on all rum produced in or imported to the United States. That money — amounting to hundreds of millions of dollars — then gets funneled back to Puerto Rico and the USVI, which in turn use it to offer generous tax breaks to multinationals that produce rum in their territories.

Despite their extensive campaign, Caribbean nations such as Barbados, Trinidad and Tobago, Guyana, Jamaica and others failed to convince the U.S. government that the tax amounted to a subsidy. Buried in the so-called fiscal cliff tax deal that passed Congress in early January was a provision extending the rum excise tax.

Now, Caribbean states are left pondering whether to haul the United States before the WTO to resolve the row, though doing so would be a costly, lengthy undertaking.

Ambassadors Neil Parsan (Trinidad & Tobago); Anibal de Castro (Dominican Republic) and John Beale (Barbados) compare bottles of their island’s national rum brands. (Credit: Larry Luxner)

‘Pursue all avenues’

At the 35th meeting of the Caricom Council for Trade and Economic Development, which was chaired by Jamaican Foreign Affairs Minister A.J. Nicholson, delegates urged the trade bloc to “pursue all avenues available” to secure a resolution “that restores the competitive balance in the marketplace.”

Beale warned that Barbados and its fellow Caricom states could very quickly find themselves priced out of the market if cheaper rums from Puerto Rico and the USVI are allowed to flood U.S. liquor-store shelves thanks to unfair trade preferences.

“This is not just a subsidy to assist someone. It completely distorts and wipes out the competition,” Beale complained. “Diageo has more money than we can ever dream about. Something seems a bit odd there. Something doesn’t add up.”

Added Trinidadian Ambassador Neil Parsan: “The Diageo plant’s production capacity is far greater than the total production capacity of the Caribbean. There’s an economy of scale coming out of the U.S. Virgin Islands that renders the [rest of the] Caribbean uncompetitive.”

Diageo, for those not familiar with the drinks world, is a British conglomerate and the planet’s largest producer of spirits, with annual sales of $17 billion — an amount that far exceeds Jamaica’s annual GDP. Its brands include Smirnoff (the world’s best-selling vodka), Johnnie Walker (the world’s best-selling Scotch whisky), Baileys (the world’s best-selling liqueur), and Guinness (the world’s best-selling stout).

But its opponents throughout the Caribbean paint Diageo officials as modern-day pirates, looting their struggling countries’ treasuries of hard-earned foreign currency in the corporate quest for more and more profits.

Diageo is a British conglomerate and the planet’s largest producer of spirits, with annual sales of $17 billion. (Credit: Tim Bishop for Diageo PLC)

Diageo’s move rocked industry

In 2009, Diageo rocked the beverage industry when it announced it would move production of its popular Captain Morgan Spiced Rum from Puerto Rico to a sparkling new distillery in St. Croix. The drinks giant had considered Honduras and Guatemala as possible low-cost options as early as 2007, but decided on the USVI after the territory’s government agreed to provide it with $2.7 billion in tax benefits over a 30-year period.

The move prompted bickering between the two U.S. possessions amid calls for a boycott of Diageo products by the New York-based National Puerto Rican Coalition.

Frank Ward, chairman of the Barbados-based West Indies Rum and Spirits Producers’ Association (WIRSPA), said the Diageo deal in St. Croix “opened the floodgates” — much to the Caribbean’s disappointment.

“The USVI started the ball rolling, and Puerto Rico began matching it dollar for dollar,” he complained. “The money being diverted to those two territories is globally distorting our trade. It’s also a violation of America’s WTO obligations.”

Ward, who’s been chairman of WIRSPA since 2007, said rum exports generate about $700 million a year in foreign exchange and more than $250 million in tax revenues for the 15 Caricom states and the Dominican Republic, which together comprise the Caribbean Forum (Cariforum).

At least 15,000 workers are directly employed in rum production throughout the region, and another 60,000 people indirectly hold jobs in that sector — though some countries are more vulnerable to large-scale competition than others.

“The Barbados rum industry is severely threatened by subsidies given to Puerto Rico and the USVI,” Ward said. “Our beef is really with the subsidies given to the rum companies, not with the program itself. Some of our member companies have already seen massive losses because of their inability to compete on price.”

In an interview with BeverageDaily.com, however, Diageo countered that the firm sourced the same amount of rum from Caribbean producers that WIRSPA reported its members exported to the U.S. market.

Caricom rum exports to the United States also rose 39 percent in the first four months of 2012, the firm said, before warning: “These valuable relationships could be disrupted by a Caricom challenge at the WTO, which would force Diageo to re-evaluate its activities in the Caribbean.”

Diageo also defended Washington’s “cover-over” program and said its distillery in St. Croix has to date only produced branded rum for the premium U.S. market.

“This means that Diageo is not flooding the U.S. market with rum, and Diageo’s premium rum does not compete with, much less displace, the bulk rum produced by WIRSPA members,” the company said in a press statement. “And none of Diageo’s USVI rum is sold outside of the United States.”