Pierluisi calls PR-USVI rum rivalry a ‘race to the bottom’

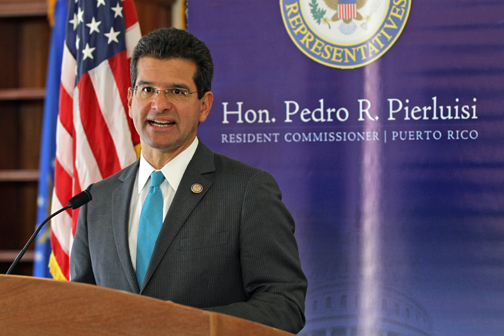

“If we don’t regulate the use of these cover-over funds, this will become a race to the bottom,” says Puerto Rico’s Resident Commissioner Pedro Pierluisi.

Editor’s Note: This is the second of a three-part series News is my Business will publish this week on the escalating rum tax debate.

WASHINGTON — Puerto Rico isn’t a country, so unlike most of its English-speaking Caribbean neighbors, it doesn’t have an embassy in Washington. And it’s not a state either, so it can’t send to Congress the eight lawmakers — two senators and six representatives — its population of 3.7 million would warrant under statehood.

What it does have on Capitol Hill is Democratic Rep. Pedro R. Pierluisi, the island’s non-voting resident commissioner. And Pierluisi isn’t too happy at the moment.

He claims that the U.S. Virgin Islands — Puerto Rico’s much smaller neighbor to the east — is using federal subsidies to fuel its growing rum industry at the expense of Puerto Rico and other Caribbean islands.

Funny, because that’s exactly what Caribbean diplomats are accusing Puerto Rico of doing, too.

The complicated debacle has put Puerto Rico in the ironic position of having to urge Congress to limit the amount of rum excise-tax rebates U.S. territories such as itself may earmark toward luring giant rum distilleries to their jurisdictions. The rebates are a financial windfall for Puerto Rico, bringing in more than $449 million in fiscal 2011. The USVI, which began receiving similar benefits in 1954, got $133.5 million in revenues.

John Beale, the Barbados ambassador in Washington, said he and his fellow ambassadors from the 15-nation Caribbean Community (Caricom) have met with the U.S. Trade Representative’s Office to plead their case, but to no avail.

“Back in June, the West Indies Rum & Spirits Producers Association came up here and met with people from the State Department and the USTR. My background is in business, and it was quite clear to me that the USTR is in no position to take on something that is absolutely minuscule. We would get nowhere with them,” he said. “We should consider going to the WTO, because that’s the only way to get Washington’s attention.”

Various rum brands from the Caribbean (left to right): 10 Cane (Trinidad & Tobago); English Harbour (Antigua & Barbuda); Brugal (Dominican Republic); Rhum Barbancourt (Haiti); Chairman’s Reserve (St. Lucia) and 1 Barrel (Belize). (Credit: Larry Luxner)

Rebates ‘distort competition’

Pierluisi believes the rebates — which subsidize rum production — distort fair competition and are needlessly excessive. He also says too much of this money gets directed back to rum distillers instead of being used for economic development.

In an interview, Pierluisi said that since taking office in 2009, he’s introduced two bills — one in the 111th Congress and one in the 112th — attempting to curb the practice.

The first bill called for a 10 percent cap on the amount of “cover-over incentives” either Puerto Rico or the USVI could offer rum producers. When the bill went nowhere, Pierluisi reintroduced the legislation, this time with a 15 percent cap. But that second bill failed to gain traction as well.

“My longstanding position on this issue has been that rum producers should be competing among themselves based on the quality of their products and the prices they sell them at — not the amount of incentives or subsidies they get from territorial governments,” Pierluisi said.

“Unless Congress imposes some caps here, Puerto Rico would have to offer similar incentives, and that’s what has ended up happening,” he said. “Unfortunately, the attitude in Congress at the leadership level is, let the territorial governments agree with each other and let’s not get involved.”

It’s not that Pierluisi completely disagrees with the rebates.

“If the cover-over funds were 5 or 6 percent, there would be no issue. All governments give incentives to promote industry. But these incentives are excessive,” said the congressman, noting that the USVI is now using 47 percent of these “cover-over” funds to offset the cost of constructing a $165 million distillery on the island of St. Croix.

In effect, he argues, this amounts to a massive tax break for Diageo, the British drinks conglomerate that recently shifted production of Captain Morgan Spiced Rum to that St. Croix distillery. Previously, the premium rum brand was produced by Destillería Serrallés in Ponce.

The USVI has also entered into a similar deal with Fortune Brands, which produces Cruzan Rum in St. Croix.

In response, Pierluisi said, “Puerto Rico ended up enacting a law allowing the local government to give exemptions at the rate of 47 percent of cover-over funds to local producers Bacardi and Serrallés. So now, both territories [Puerto Rico and the USVI] are using close to half of these funds to incentivize their respective rum industries. That’s not an ideal situation. It’s un-American. It’s not the way we run businesses in America.”

Imposing reasonable limits

Pierluisi said he’s been working closely with two Democratic senators — Robert Menendez of New Jersey and New Mexico’s Jeff Bingaman, who just left the Senate — to impose reasonable limits on the amount of cover-over funding that can be used by each territorial government to subsidize its rum producers, but that “this effort has been resisted by Diageo and by the USVI.”

Pierluisi said he’s tried to reason with Virgin Islands Gov. John de Jongh and the territory’s non-voting delegate in Congress, Donna Christensen, “but from day one, their position was this deal was cut in stone. The USVI was committed to defending the deal and not doing away with incentives they promised Diageo.”

The resident commissioner said he completely understands the position Caricom finds itself in.

“Ever since the 1980s, we’ve had a law imposing a 10 percent cap. The purpose of this law was to ensure that the government of Puerto Rico would use the funding for meeting its fiscal obligations in a wide range of areas — economic development, social well being, education and conservation of natural resources,” he said.

“If we don’t regulate the use of these cover-over funds, this will become a race to the bottom. Puerto Rico will have no choice but to match the incentives the USVI is giving. Otherwise, producers could end up leaving our territory just to get a better deal.”