U.S. Embassy opens in Havana to praise for new policy

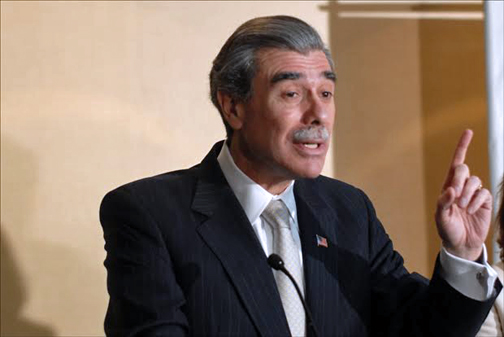

Former U.S. Commerce Secretary Carlos Gutiérrez, once an embargo supporter, now backs President Obama’s move to normalize diplomatic relations with Havana. (Credit: Larry Luxner)

WASHINGTON — At precisely 10 this morning, the Cuban flag will flutter for the first time in more than half a century over its stately old mission on Sixteenth Street — marking the opening of Washington’s newest embassy in years.

Also this morning, the six-story U.S. Interests Section fronting Havana’s oceanfront Malecón will open for business for the first time in decades as a full-fledged embassy.

Last week, Carlos Gutiérrez — the Cuban-born former secretary of commerce under President George W. Bush — told a panel at the Atlantic Council why he thinks the Obama administration is right to reverse course and open up to Cuba after 54 years of the White House doing exactly the opposite.

“This is more than just symbolism. It’s a real step forward,” said Gutiérrrez, long a staunch supporter of the U.S. embargo against the Castro regime. “Cuba wants to change. But as we all know, there’s so much more to do.”

The event, sponsored by the council’s Adrienne Arsht Latin America Center, coincided with release of a report by Cuban economist Pavel Vidal and Scott Brown, former IMF mission chief for Albania. The 24-page study, titled “Cuba’s Economic Reintegration: Begin with the International Financial Institutions,” examines how former centralized economies like Albania and Vietnam were helped by membership in the World Bank, the International Monetary Fund and regional development banks.

“Cuba withdrew from the World Bank in 1960, and from the IMF in 1964. It was never a member of the Inter-American Development Bank because the IDB started in 1959 — the year of the revolution — so Cuba doesn’t really know the benefits of investment capital,” said Gutiérrez.

“Cuba wants to change,” he added. “I’ve been traveling to China now for about 20 years, sometimes as often as five or six times a year. More than 300 million Chinese have been lifted from poverty. It’s a great example of economic transition. Albania is another one.”

Under the Helms-Burton Act of 1996, which codifies the U.S. embargo into law and can only be lifted by Congress — regardless of President Obama’s decision to restore diplomatic ties — Washington must oppose Cuba’s entry into all these institutions.

“But one thing is to oppose, and the other is to encourage everyone else to oppose,” Gutiérrez pointed out. “If the U.S. government wants to be part of the solution, the United States can comply with Helms-Burton and vote no, and then allow others to vote as they wish, as opposed to putting on pressure. It’s up to U.S. policymakers to help Cuba, but I’d be surprised if this is not part of the talks. If it isn’t, it should be.”

However, this isn’t just about the Helms-Burton Act.

“For one thing, Cuba can’t continue with two currencies. That will not make sense in an economy open to foreign investors,” said the former commerce secretary and Coca-Cola executive. “Unifying two very distinct currencies won’t be easy. It will reduce foreign reserves in the short term and will be a tough transition. And you can’t do it overnight.”

Even more importantly, he said, is that the Cuban government allows private entrepreneurs to turn a profit — whether it’s a restaurant or a home-repair store.

“For me, the most important requirement is a recognition that you need to have a return on capital,” said the former commerce secretary and Kellogg official. “Cuban policymakers need to fully understand that — and if they do understand it, then they need to put it in place. If you’re going to access these institutions and access capital, you have to believe that capital must have a return. For me, this is not ideology, it’s about numbers. If you’re putting in money and not getting out money, you’re not going to be successful.”