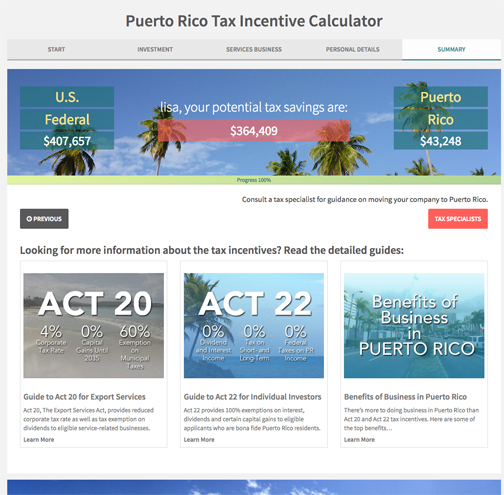

PR Business Link launches ‘Tax Incentive Calculator’

PR Business Link, an organization that caters to recipients of government incentives through Acts 20/22, on Monday launched a new “Tax Incentive Calculator,” an online tool to help entice new investors and businesses to Puerto Rico, which will bring new and increased business to local companies.

Act 20 and Act 22 tax incentives continue to draw new residents and businesses to the island, helping to boost the economy and creating new jobs. Since Acts 20 & 22 were written into law in January 2012 there have been more than 1,600 decrees issued.

When business owners and investors learn about the benefits of the tax incentives, they need to consider many factors to decide to make the move, making it important for them to understand the potential savings as early in their research as possible, said Lisa Cogliati, founder of PR Business Link.

The free “Tax Incentive Calculator” provides this information with less than 10 questions. The website also offers links to detailed tax guides for Acts 20/22, and other tax information.

“We want to make it easy for investors and business owners to see the benefits of moving to Puerto Rico. At PR Business Link we are committed to continue helping local companies by referring newcomers to their businesses and services,” said Cogliati.

“With a simple user interface and no more than 10 questions, prospect investors and business owners will see their potential tax liabilities in the U.S. (federal) and Puerto Rico as well as the savings they may have by moving,” she said.

“Puerto Rico is undergoing difficult situations but it is an amazing place to live in. We want to be part of the solution and contribute to bring increased business and economic development to the island,” said Cogliati.

Act 20 can benefit export service businesses with a 4 percent corporate tax rate through 2036 for services performed in Puerto Rico, and requires companies to hire at least five employees. It is estimated that Act 20 will have a $38.5 billion economic impact in Puerto Rico by 2024.

Meanwhile, Act 22 for individual investors offers 100 percent tax exemption to new residents on short-term and long-term capital gains accrued (after establishing residency) and 100 percent tax exemption on interest and dividends from Puerto Rico sources.