Moody’s: PREPA still open to consensual restructuring

The extension of the RSA coincides with the current termination date for the RSA itself and is longer than the Feb. 28 date that PREPA’s bondholder group had originally sought. (Credit: © Mauricio Pascual)

Recent events related to the ongoing negotiation between the Puerto Rico Electric Power Authority and its creditors, including an extension through March 31 of the restructuring support agreement, suggests there’s still room for consensual accords, Moody’s Investors Service said in an analysis released Thursday.

The firm noted the agreement announced Jan. 27 by the Fiscal Agency and Financial Advisory Authority that it had agreed to extend talks, “a key milestone” in the talks.

“We view this extension as supportive of the efforts toward an organized restructuring as it indicates continued governmental and regulatory support and flexibility,” Moody’s said.

“Having said that, we note that deadlines have come and gone before. There is still uncertainty related to the final execution on this complex restructuring as well as its ultimate recovery, and the Caa3 rating remains unchanged,” the agency said.

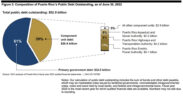

The extension coincides with the current termination date for the RSA itself and is longer than the Feb. 28 date that PREPA’s bondholder group had originally sought. PREPA has about $9 billion in outstanding debt with its creditors.

“The change suggests that the Puerto Rican government and the AAFAF are supportive of allowing more time for parties to discuss the terms of the restructuring agreement,” Moody’s suggested.

The specific milestone relates to the date by which PREPA and its creditors had to reach agreement on the choice of the relevant Title (Title III or Title VI) under the Puerto Rico Oversight, Management and Economic Stability Act, or another mutually agreeable mechanism necessary to implement the RSA transactions.

Title III of the Act allows for in-court adjustments of debts similar to a Chapter 9 municipal bankruptcy, while Title VI of the Act, the expected approach, allows for the implementation of PREPA’s proposed restructuring as part of a pre-existing voluntary agreement.

Meanwhile, on Jan. 10, the Puerto Rico Energy Commission approved the final rate order for a base-rate increase for PREPA of 1.025 cents per kilowatt-hour (kWh).

“While lower than the temporary base-rate increase of 1.299 cents/kWh approved by the PREC in June 2016, we understand that the lower rate reflects reduced revenue requirements for PREPA,” Moody’s said.

“The base-rate had not been changed since 1989. This increase should help stabilize the utility’s longer-term financial position and is in addition to the PREC’s approval, also in June, of a 3.1 cents/kWh surcharge to cover debt service on the securitization bonds that PREPA expects to issue as part of its debt restructuring,” the agency added.

As that is happening, three of the seven lawsuits brought by interested parties challenging the validity of the surcharge and PREPA’s restructuring are being withdrawn. In addition, a lower court recently ruled in PREPA’s favor in a fourth validation case, a case brought by PREPA’s largest union, which has filed an appeal with the Puerto Rico Supreme Court.

According to PREPA’s management, they continue to seek to consolidate the remaining three lawsuits into one case, Moody’s stated.

“These developments suggest continued steady, albeit slow, progress toward completing a consensual debt restructuring. However, uncertainty around executing this complex restructuring remains,” the ratings agency said.

“Recent news reports suggesting that the Puerto Rican authorities may seek more concessions and debt relief from PREPA’s creditors highlight this uncertainty,” it noted.

This risk remains a possibility given the uncertain status of the debt restructuring plans for debt issued by the Commonwealth of Puerto Rico (Commonwealth, Caa3 developing) and the continued economic challenges across the Commonwealth, Moody’s concluded.