P.R. Treasury reports revenue increases in August, September

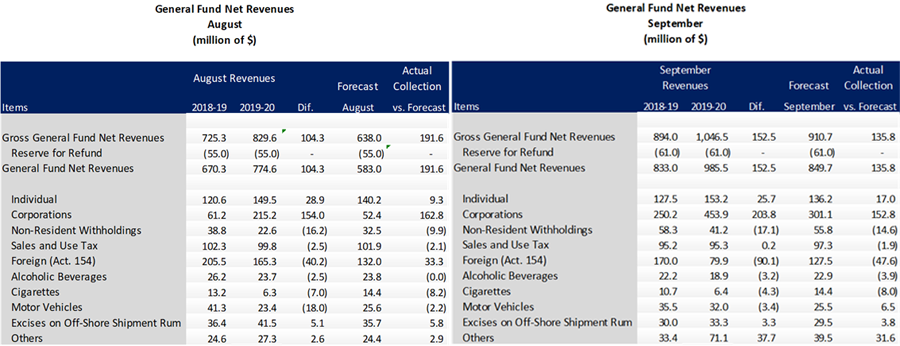

Preliminary net revenues to Puerto Rico’s General Fund in August and September totaled $773.6 million and $985.5 million, respectively, Treasury Secretary Francisco Parés-Alicea announced.

This reflects a year-over-year revenue increase of $103.3 million in August and $152.5 million in September.

“The first quarter ended with revenues that totaled $2.8 billion. Compared to the same period during the previous fiscal year, this reflects an increase of $563.4 million, or 25.1%,” he said.

The corporate income tax category was the main revenue driver, which totaled $924.9 million in the July-September period. This reflected a $524 million increase during the fiscal period, attributed in part to a non-recurring capital gains transaction for a considerable amount made by a corporate entity.

Another revenue category responsible for the increase in the first quarter was the income tax revenue paid by individuals.

“During the first three months of the fiscal year, revenues in this category totaled $445.9 million, a year-over-year increase of $67.5 million,” Parés-Alicea said.

“This reflects an improvement in this category during these first months, which was anticipated by other employment and participation indicators that reflect an encouraging behavior for the economy,” he added.

Fiscal year-to-date Sales and Use Tax (SUT) revenues totaled $287.9 million, which reflected a $12 million year-over-year decrease, which reflected a change in the way that collections are recorded, the agency said.

The implementation of a new methodology to report SUT collections involves the publication of a new report, which presents the July to September periods for this fiscal year and includes the changes required by the Sales Tax Financing Corp. (known as COFINA) bond restructuring and COFINA’s Third Amended Plan of Adjustment under Title III of PROMESA.

Through this new report, the Treasury Department provides accurate information on the distribution of the SUT that goes to COFINA and the General Fund. The implementation of the new methodology implies that the SUT reported during this fiscal period cannot be compared to the one reported for prior fiscal periods, he said.

The Treasury Secretary explained that one of the main differences of this new methodology is the biweekly payments pending the filing of returns and overpayments by large taxpayers; therefore, the reduction with respect to the prior fiscal year is attributed mainly to the discrepancy between periods with different methodologies.

On the other hand, fiscal year-to-date (July-September) excise tax revenues totaled $811.4 million, which reflected a year-over-year increase of $20.5 million.

A considerable amount of the revenues accounted for in the “other excise taxes” category is for payments related to cigarettes and tobacco products. These payments are categorized as “other excise taxes” because the taxpayers’ declaration is pending.

Parés-Alicea said one of the advantages of the Unified Internal Revenue System (SURI, for its initials in Spanish) is that it allows visibility of this level of detail of information, making the system administration more efficient and allowing taxpayers to know the status of the processing of their tax transactions.