Rosselló signs Opportunity Zones Development Act

Gov. Ricardo Rosselló signed into law today Senate Bill 1147, which establishes the regulatory framework for the development of Opportunity Zones in compliance with the Federal Tax Reform of 2017.

The Opportunity Zones created under federal law provide tax benefits to low-income communities in order to achieve their economic development.

Puerto Rico, as well as several other jurisdictions in the United States, must comply with certain population and economic criteria to obtain the numerous benefits provided by the federal law.

“From now on, Puerto Rico will benefit from the Opportunity Zones Development Act. This statute makes us the best place in the nation to invest, since it will promote millionaire investment and the creation of thousands of new jobs,” Rosselló said.

“But above all this measure will have a significant impact on the recovery of Puerto Rico after the passage of Hurricane Maria,” said the governor.

Rosselló also stated “today we are not only advancing toward a fairer society, but we are providing access to capital in different areas that will allow Puerto Rico to be even more competitive.”

It has been estimated that this law will generate more than $600 million in capital investment and boost the transition of the most vulnerable areas of the Island to a fairer and more favorable economic situation.

Under the Opportunity Zone modality, investors may defer capital gains tax on the sale of an asset, carried out prior to January 1, 2027, if they invest an amount equal to the profits earned in a Qualified Opportunity Fund.

An Opportunity Zone, in general, must have a population census within the state that qualifies as a low-income community, as defined in Section 45D(e) of the Federal Internal Revenue Code.

To qualify as a low-income community, the applicable population census cannot have a poverty level of less than 20%, nor can it have an average household income that exceeds 80% of the median state or metropolitan area income, depending on the location of the population census.

As a result of the efforts by the local Government in Washington, DC, 97% of the Island was designated as an Opportunity Zone, encompassing all low-income communities in Puerto Rico. This makes the Island more attractive in the investment field, the governor’s office said.

The new measure proposes an incentive framework for a 15-year period to achieve the economic development provided under this law.

Some of the key aspects of this law include 18.5% tax on the net income of an exempt business; dividend tax exemption; 25% exemption from patents and property taxes; and 25% exemption from construction taxes.

The new measure also includes a maximum investment credit of 25%, transferable; a credit preference system for priority projects in Opportunity Zones; and capital gains tax deferral for profits invested in a qualified opportunity fund on the Island under rules similar to those passed in the federal legislation.

There will also be tax exemption for interest earned on loans to exempt businesses; as well as a fast procedure for the evaluation and issuance of permits for exempt businesses and projects agreed in an alliance contract in accordance with Act 29-2019, as amended.

The government’s Chief Investment Officer, Gerardo Portela, said Puerto Rico, unlike other jurisdiction, “has an exceptional regulatory framework that facilitates and promotes capital investment in low-income communities.”

“Puerto Rico is an American territory that has a largely bilingual and highly qualified workforce for jobs in various industries and economic areas, so this law facilitates citizens’ access to these important areas,” he said.

For his part, the governor thanked the Legislative Assembly for the prompt approval of this administration bill, which took place April 24.

“We appreciate the participation and support of both the Unites States Treasury and the Department of Housing. Their support is essential in the economic development of the Island, as well as on the success of this bill,” Rosselló concluded.

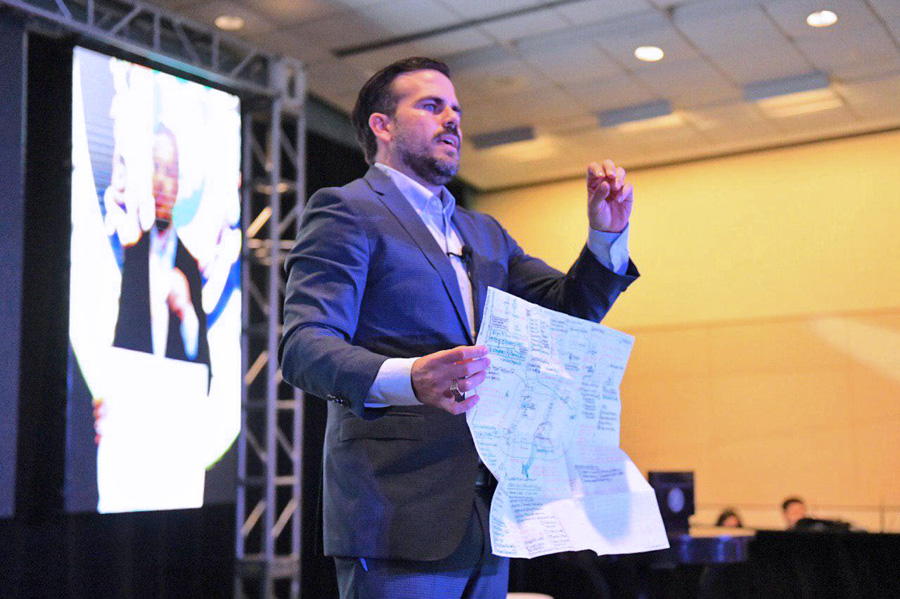

Rosselló signed the bill today during the First Opportunity Zones Summit, held at the Puerto Rico Convention Center, where hundreds of local, national, and international investors participated in investment project forums and their access to them.

Among the panelists participating in the summit were Rosselló; Rodrick Miller, Chief Executive Officer of Invest Puerto Rico, as well as the secretary of the Department of Economic Development and Commerce and executive director of the Puerto Rico Industrial Development Company, Manuel Laboy.

The event also included the participation of the advisors to the secretary of the Treasury, Daniel Kowalski and Brad Wandt; the regional administrator of the U.S. Department of Housing and Urban Development, Denise Cleveland; the Executive Director of the Central Office for Recovery, Reconstruction and Resiliency (COR3), Omar Marrero; Portela; as well as several bankers and other experts in tax laws and investments.