Study: Puerto Rico towns ‘have made notable progress’ in financial health

The report encourages municipalities to build on their recent successes and focus on long-term financial sustainability.

Puerto Rico’s municipalities have made notable progress in improving their financial health, according to the latest Municipal Fiscal Health Index released by nonprofit ABRE Puerto Rico.

The report, now in its 10th edition, analyzes the financial performance of the island’s municipalities based on audited financial statements, and the findings suggest a positive shift in municipal fiscal management, particularly for the year 2022.

For the first time in more than a decade, less than half of Puerto Rico’s municipalities reported a revenue deficit or overspending in their general fund, marking a significant improvement compared to previous years. In 2022, only 44% of municipalities faced a revenue shortfall, compared to rates as high as 55% to 60% in prior years.

“This is the best overall financial health we’ve observed since we began this analysis,” said Ángel J. Sierra-Alemán, executive director of ABRE Puerto Rico.

He highlighted key areas of improvement, including a reduction in the number of municipalities with declining net assets, a stronger general fund balance and less reliance on the central government’s general fund.

The 2022 report presents an encouraging outlook of Puerto Rico’s municipalities. Only 4% of municipalities reported a decrease in net assets, a substantial improvement compared to 54% in 2020 and 23% in 2021.

Furthermore, only 16% of municipalities experienced a decline in their general fund balance, down from 32% in 2021 and 44% in 2020. Additionally, 22% of municipalities ended the year with a negative general fund balance, marking a reduction in deficits across the island, according to the index.

One of the most significant indicators of improvement is the reduction in the municipalities’ reliance on state funding. Only 10% of municipalities now receive more than 40% of their income from the central government, a clear sign of increased financial independence.

Sierra-Alemán attributed these improvements to two key factors: enhanced fiscal discipline by municipalities and the critical support from federal funds, particularly from the Federal Emergency Management Agency.

The reduced availability of state funds and a limited capacity to issue debt have prompted local governments to manage their resources more prudently, while federal aid has provided much-needed financial relief, he said.

New classification system

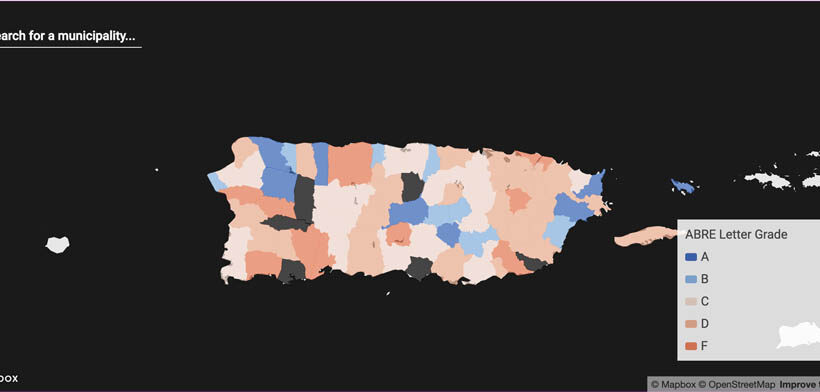

This year, ABRE Puerto Rico introduced a new classification system in its rankings, moving away from traditional letter grades to more descriptive categories. The new classifications include “Solid,” “Healthy,” “Stable,” “Vulnerable” and “In Crisis,” replacing the former A-F grading scale.

The organization hopes the updated system will foster more productive discussions about the financial health of municipalities and encourage collaborative efforts to address fiscal issues.

Despite the overall progress, some municipalities continue to face fiscal challenges. At the top of the rankings, Orocovis, Culebra, Lares, Hatillo, Fajardo, San Sebastián and Vega Alta were identified as municipalities with the best fiscal health in 2022, all classified as “Solid.” On the other end of the spectrum, Yabucoa, Salinas, Ciales, Maunabo and Santa Isabel were marked as “In Crisis.”

The index highlights the ongoing efforts of several municipalities to strengthen their financial health. Aguas Buenas, Naranjito, and Comerío, among others, showed notable improvements, moving up from lower classifications to healthier fiscal statuses. Overall, 22% of the municipalities improved their fiscal health compared to 2021, while 53% maintained their positions, and 24% experienced a decline.

Despite these gains, some municipalities continue to struggle. However, the report emphasizes that a decrease in fiscal health does not necessarily indicate a crisis. For example, towns like Aibonito and Barranquitas saw their ratings dip from “Solid” to “Healthy,” which still reflects a stable financial situation.