Puerto Rico No Se Vende study highlights political donations from tax break beneficiaries and the government analyzes the performance of economic incentives. #NewsIsmyBusiness

An audit revealed gaps in compliance and regulation for incentives under acts 20 and 22. #NewsismyBusiness

With the new guidance, anyone who participates in blockchain validation can receive a 4% tax benefit.

Aimed at educating entrepreneurs, community leaders, founders and investors on how to "take advantage of the benefits of Law 60."

The actions came from the agency’s Incentives Office.

Puerto Rico’s Act 20 and Act 22 have generated 36,222 jobs and $1.2 billion in investments on the island from 2012 to 2019, a study revealed by the Department of Economic Development and Commerce confirmed. According to the study on the performance of the government’s incentives programs, commissioned to the Estudios Técnicos research firm, the […]

Doing the work of promoting Puerto Rico beyond its shores is an important task, but the island must continue working on its structural issues so that it becomes a place where doing business works, said Ignacio Álvarez, CEO of Popular Inc. during a recent sit-down with the media. “You can sell something, but if after […]

Reaching those markets will be the focus of one of the panel discussions in the group’s upcoming “Made in Puerto Rico Export Summit: Dare to Grow” event, slated for Nov. 8.

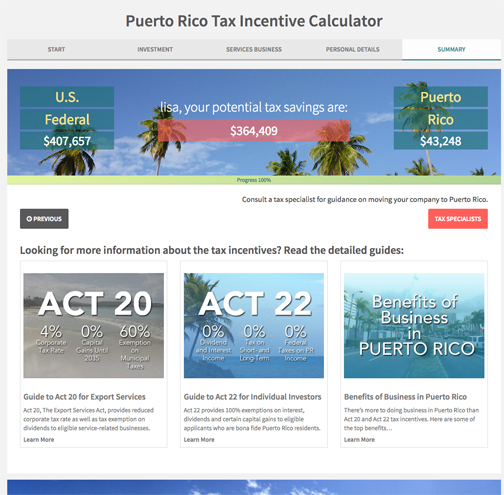

PR Business Link, an organization that caters to recipients of government incentives through Acts 20/22, on Monday launched a new “Tax Incentive Calculator,” an online tool to help entice new investors and businesses to Puerto Rico, which will bring new and increased business to local companies.

NIMB ON SOCIAL MEDIA