New Certified Professional program aims to cut wait times and boost certainty for businesses applying for tax decrees. #NewsismyBusiness

Juan Castañer of Estudios Técnicos analyzes the scope of Puerto Rico’s tax incentives and calls for closer monitoring to prevent misuse. #NewsismyBusiness

The Puerto Rico No Se Vende coalition warns of deepening inequality as the government expands audits to curb noncompliance under Act 60. #NewsismyBusiness

New study highlights island’s rapid renewable expansion as Gov. Jenniffer González pledges to defend net metering and accelerate energy transformation. #NewsismyBusiness

The agency has audited nearly 1,800 decrees in 2025, tightened background checks, and expanded penalties to ensure compliance with Act 60. #NewsismyBusiness

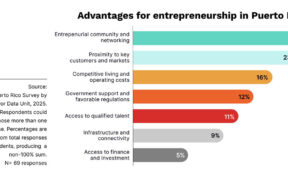

Report finds red tape, service instability and job insecurity hurt competitiveness. #NewsismyBusiness

New fund targets tax-advantaged investments in local businesses and projects. #NewsismyBusiness

The new rate applies to capital gains, interest and dividends under the Incentives Code beginning next year. #NewsismyBusiness

The L60 Guidebook is part of PRBTA’s broader L60 education initiative. #NewsismyBusiness

The collaboration aims to help South Korean firms establish a U.S. market presence through Puerto Rico’s tax incentives. #NewsismyBusiness

Known for innovative, favorable tax climate, the Cayman Islands finishes first in 2024, with the Dominican Republic rounding out the top 10. #NewsismyBusiness

A new report reveals significant campaign contributions from Act 22 beneficiaries. #NewsismyBusiness

Raúl Burgos explains how these remote workers can bring innovation to the island. #NewsismyBusiness

When he moved to Puerto Rico in 2017, Brock Pierce, an investor in a range of experimental crypto ventures, made headline-grabbing promises to revive the local economy. #NewsismyBusiness

NIMB ON SOCIAL MEDIA