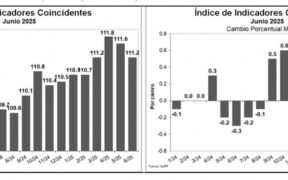

Composite indicators reflect tempered growth and easing recession risks despite inflationary pressures. #NewsismyBusiness

Planning Board’s Economic Report reveals demographic shift, 2.1% GDP growth. #NewsismyBusiness

SBA Regional Director Matt Coleman highlights loan surge, local staffing and new tools to boost the island’s resilience. #NewsismyBusiness

Puerto Rico’s changing economic landscape will prompt banks to keep a tight grip on their activites until risks recede, an analysis by H. Calero Consulting firm concluded. The “retrenching,” as the firm called it, will likely lead banks to remain a “passive sector, one that, in the future, stands to react rather than lead the […]

In a recently released paper, the firm predicted that while growth for the 2018 calendar year will be “0,” prospects for 2019 depend on the amount and rate of federal funds disbursed for the island’s recovery efforts.

Under “Austerity vs. Green Growth for Puerto Rico” plan proposed by Amanda Page-Hoongrajok, Shouvik Chakraborty and Robert Pollin, Puerto Rico would the possibility of establishing a viable domestic energy infrastructure.

Puerto Rico’s small- and mid-sized business sector showed a 4 percent year-over-year growth last year, when some 207,867 were in operation, up from the 199,848 up and running in 2014.

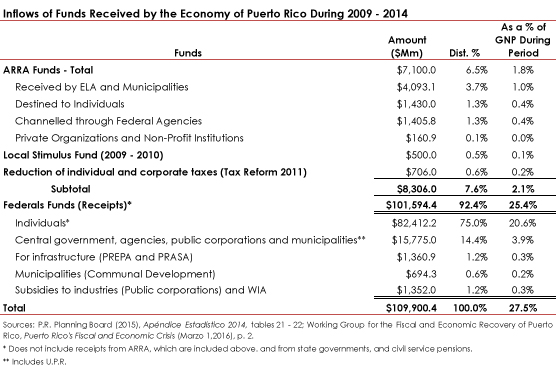

In the years between 2009 and 2014, the economy of Puerto Rico had an inflow of funds (federal government and other sources) of about $110 billion.

Puerto Rico Planning Board President Luis García-Pelatti told lawmakers over the weekend that the island will experience negative economic growth of 1.3 percent and 4.2 percent, respectively in Fiscal 2015 and 2016, when the scenario is looked at from a pessimistic point of view.

The government’s proposed budget for Fiscal 2015 is an “emergency budget” that should not be confused with the fiscal framework Puerto Rico should have to ensure the economy works the way it wants it to in the future.

The Puerto Rico Planning Board released Tuesday its economic projections for Fiscal years 2014 and 2015, in which it is estimated a base growth in real Gross Domestic Product of $6.5 billion million this year, representing an increase of 0.1 percent compared to Fiscal 2013.

With a new Board of Directors and members, the Puerto Rico District Export Council outlined Wednesday its efforts to nurture and assist local businesses to achieve growth through exporting.

Puerto Rico’s economy will need about $10 billion in new investments over the next three years to grow by at least 3.3 percent annually and find its way back to more prosperous pre-recession levels. In the absence of such an unlikely windfall, it will take more than a decade to circle back to acceptable levels of progress.

Saying the bank is “here to grow,” Santander Puerto Rico President Román Blanco-Reinosa outlined the financial institution’s strategy through 2015 — a plan that calls for achieving a net profit of $100 million in three years by focusing on five core business areas. When that vision is translated into numbers, it adds up to 100x35.

Contrary to expectations of an economic improvement in 2013, some of Puerto Rico’s most prominent economists agree there is little to no growth on the horizon.

NIMB ON SOCIAL MEDIA