The Financial Oversight and Management Board for Puerto Rico filed complaints to recover more than $1 billion from holders of bonds issued in excess of Puerto Rico’s constitutional debt limit, and from firms and advisors that helped with the issuance of those bonds. The Oversight Board filed a claim against more than 20 banks, law […]

As of May 2, 2019, the Financial Oversight and Management Board for Puerto Rico has filed 230 lawsuits against suppliers of goods and services to the Commonwealth of Puerto Rico and the Committee of Unsecured Creditors Under Title III of PROMESA. The Oversight Board has entered into this scenario through a stipulation that allows it […]

The Financial Oversight and Management Board for Puerto Rico filed more than 230 complaints against individuals and entities to recover some $4.2 billion in payments by the Commonwealth of Puerto Rico that were in conflict with the U.S. Bankruptcy Code and Puerto Rico law. The complaints allow the Oversight Board to ensure that the payments […]

The Special Claims Committee of the Financial Oversight Board for Puerto Rico announced that it and the Official Committee of Unsecured Creditors in Puerto Rico’s debt restructuring have filed an objection to more than $6 billion of Puerto Rico’s bonded debt. The objection asserts that the invalid debt was issued in clear violation of the […]

The Puerto Rico Electric Power Authority’s overreliance on outside advisors continues to undercut its ability to invest in the people needed in Puerto Rico.

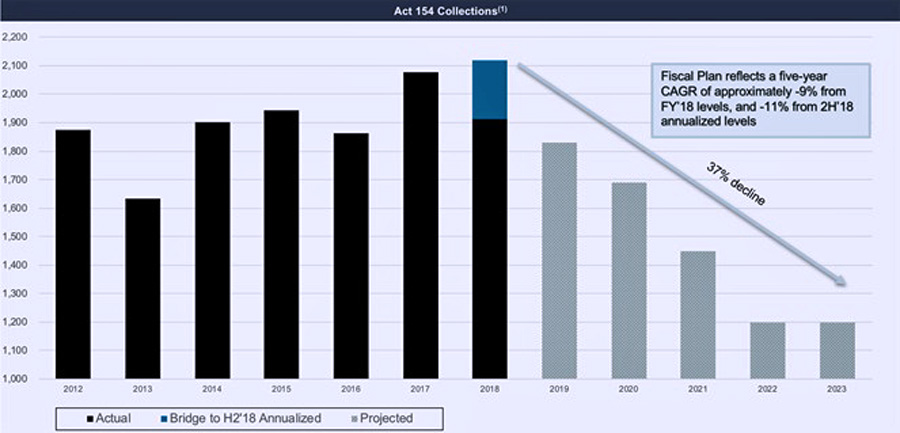

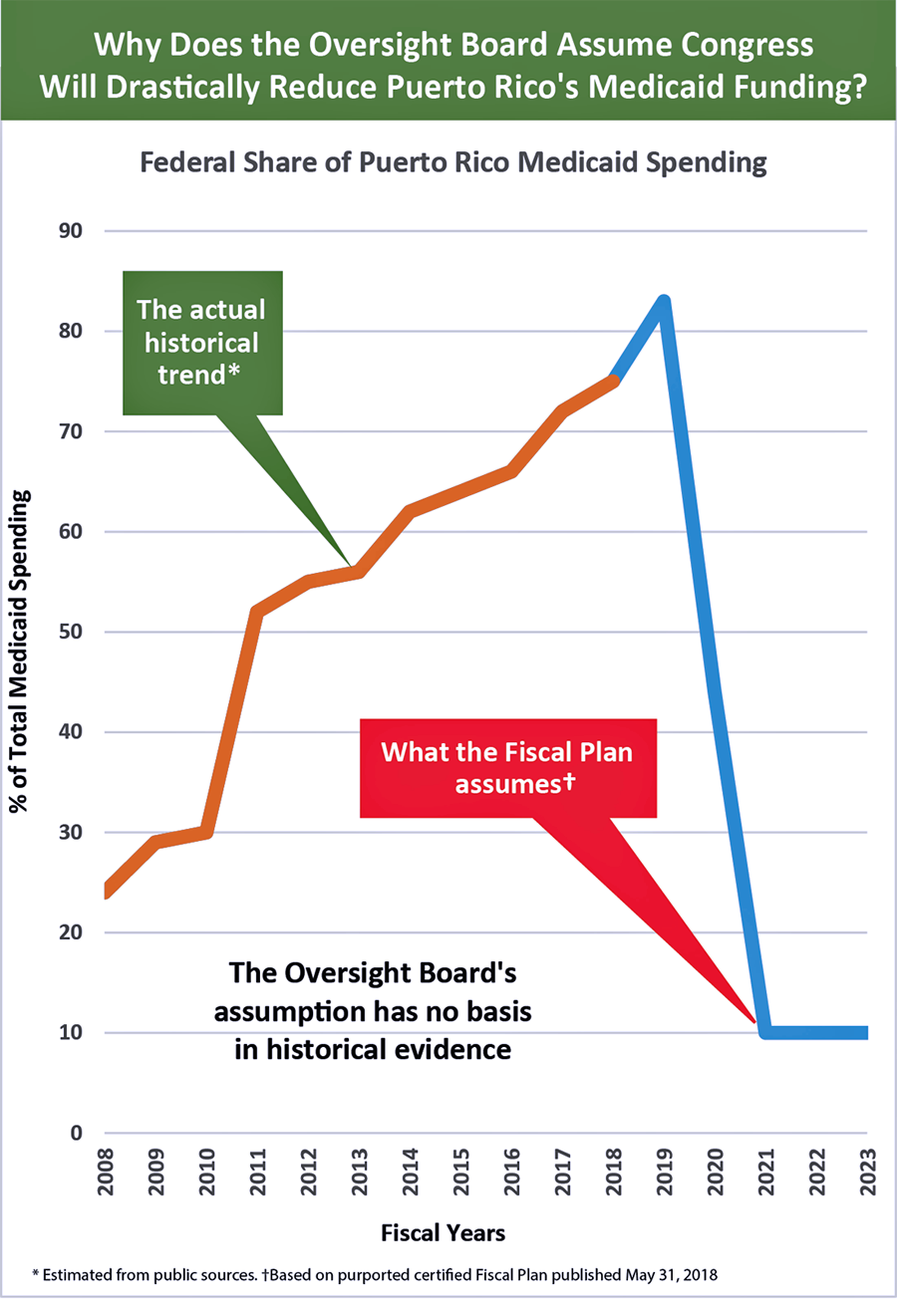

Instead of using the most probable assumptions based on actual past results, the Oversight Board relied on untested assumptions which in combination arrive at extremely low expected revenue numbers for its projections.

If the prediction of zero economic growth by 2023 holds true, the deal with COFINA creditors will lead to a new default for Puerto Rico.

In this episode of Dollar$ and $ense we talk with prominent Economists José Joaquín Villamil and Antonio Fernós about the fate of Puerto Rico's economy and the necessary steps to see a rebound.

The New Fiscal Plan for the Commonwealth of Puerto Rico has been updated to reflect more reliable revenue and expenditure data for Fiscal 2018.

This in turn will fall short of leading Puerto Rico “toward a more sustainable economic future,” the company stated.

If the measure of success of a debt settlement is that it offers realistic payouts to bondholders while allowing the debtor the ability to emerge as a going concern, then it’s time to forget about this deal.

Banco Popular added 40,000 new clients, as other financial institutions opted to close branches after Hurricane María tore through the island last year.

The Institute for Energy Economics and Financial Analysis is urging the Financial Oversight and Management Board for Puerto Rico to halt the rush to natural gas infrastructure development in Puerto Rico.

The report, which is just under 600 pages long, includes the results of its investigation into Puerto Rico’s debt and its connection to the current fiscal crisis.

The Financial Oversight and Management Board for Puerto Rico and the government of Puerto Rico announced they have reached a deal with Senior and Junior bondholders of Sales Tax Financing Corp. credit, as well as monoline insurers.

NIMB ON SOCIAL MEDIA