Long-standing CEOs delve into topics such as the future of the banking sector and their forecasts for industry development. #NewsismyBusiness

Energy costs, persisting worker shortage and Puerto Rico’s tax load are the three main concerns.

Three of Puerto Rico’s main banks — Banco Santander Puerto Rico, Popular Inc. and FirstBank Puerto Rico — banks can absorb further asset quality stress resulting from Puerto Rico’s recession for at least two more years, Moody’s Investors Service said in a report released Thursday.

During the last few years we have all been at times crushed by that uneasy feeling caused by this extended recession, and more recently by the passage of the Puerto Rico Oversight, Management, and Economic Stability Act ("PROMESA") of 2016, both of which continue to hover over our daily life as an unwelcome guest that has prolonged its visit longer than expected, refusing to leave.

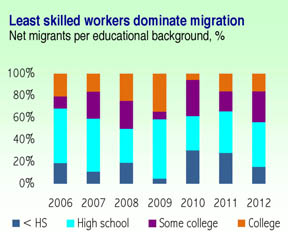

Going into its eighth year of negative growth, Puerto Rico needs to become accountable for its “sad state” of internal affairs and make a number of necessary decisions to recover growth in fiscal years to come and put an end to the prevailing sense of crisis, said economist firm H. Calero Consulting Group in the most recent edition of its internal publication “Pulse.”

Puerto Rico’s “Great Recession,” as is the case with any complex phenomena, is not without its own myths.

Puerto Rico residents have seen their personal wealth levels drop by a whopping 22 percent between 2009 and 2013, based on the performance of the Puerto Rico Stock Index over that same period of time, according to an analysis of the numbers by private firm H. Calero Consulting.

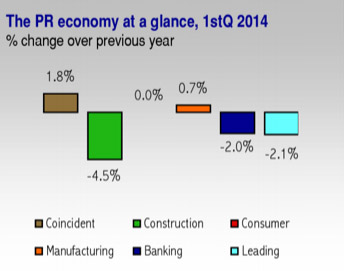

The recession that has affected Puerto Rico’s economy for the better part of the last eight years has not been consumption-driven, but has been the worst in terms of consumption deceleration, especially in the area of durable consumption, an analysis by economist firm H. Calero Consulting Group Inc. concluded.

Puerto Rico needs to find its “true north,” by aligning all of its efforts and resources toward achieving economic growth and job creation, or risk experiencing an outcome “much worse than has so far been imagined,” said economist firm H. Calero Consulting Group in its most recent edition of “Compass,” an internal publication.

The indication by members of Gov. Alejandro García-Padilla’s administration of a slight economic recovery over the past two fiscal years is “simply a mirage,” and it will take significant adjustments to achieve the growth predicted for coming years, economist firm H. Calero Consulting Group Inc. said in its most recent monthly publication.

The U.S. Census Bureau released statistics Thursday confirming that the median household income for Puerto Rico and most of its 10 largest towns held steady after the most recent recession.

José J. Villamil, one of Puerto Rico’s leading economists, offered a grim assessment of the island’s fiscal health during a lecture Tuesday at Washington’s Center for Strategic & International Studies.

Puerto Rican consumers get the equivalent of 86 cents out of every dollar they receive, which puts a significant squeeze on their purchasing power as the price of most goods and services continues to increase.

The Puerto Rico Manufacturers Association is preparing to mark its 85th anniversary during this year’s annual convention, when it will focus on ramping up its search for solutions to the island’s development and competitiveness challenges.

Puerto Rico’s economy will need about $10 billion in new investments over the next three years to grow by at least 3.3 percent annually and find its way back to more prosperous pre-recession levels. In the absence of such an unlikely windfall, it will take more than a decade to circle back to acceptable levels of progress.

NIMB ON SOCIAL MEDIA