The company received a $1.7 million tax credit for the film produced entirely in Puerto Rico. #NewsismyBusiness

US Sen. Bob Menendez (D-N.J.), a senior member of the Senate Finance Committee, and Roger Wicker (R-Miss.) reintroduced the Territory Economic Development Tax Credit Act (TEDTCA), which would create a tax credit for wages and tangible investments made by US-based businesses in US territories. This bill will support job creation and help strengthen the US […]

The government of Puerto Rico will establish work groups comprising local and federal officials, as well as private-sector executives, to brainstorm on potential alternatives to offset the loss of federal credits granted for taxes paid by manufacturing companies under the Commonwealth’s Law 154. The tax credits, which will be phased out by the U.S. Department […]

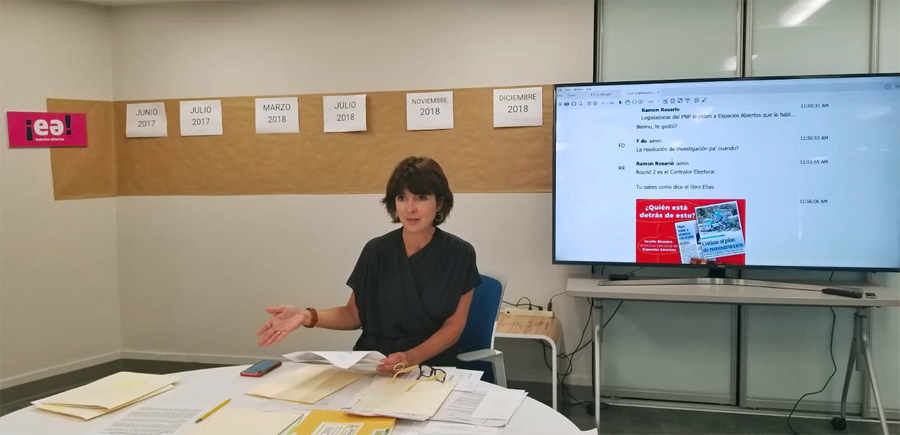

Nonprofit organization Open Spaces filed a motion before the Puerto Rico Supreme Court to overturn a decision by the Appellate Court to keep the government’s Report on Tax Reduction Agreements under seal. The report listing tax abatement agreements was prepared and delivered to the Financial Oversight and Management Board for Puerto Rico in July 2017. […]

An Earned Income Tax Credit, an issue that is taking center stage as part of the discussion of the Puerto Rico tax reform, “does justice to workers” and is “good public policy,” Cecille Blondet, director of nonprofit Espacios Abiertos, said. Upon unveiling a study it recently commissioned from Economist María E. Enchautegui, Espacios Abiertos believes […]

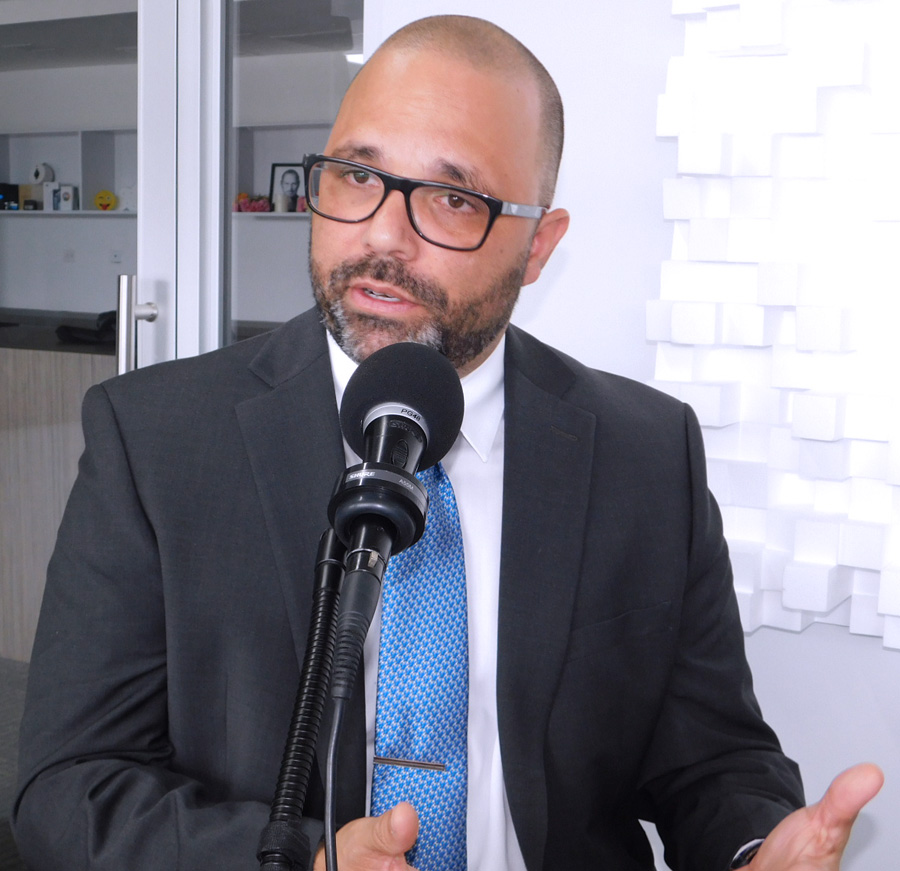

Employers affected by Hurricane Irma and Hurricane María in Puerto Rico last year will be able to access significant funds to assist with recovery efforts.

The U.S. House of Representatives passed Thursday legislation that will enable employers in Puerto Rico to get an income tax credit of up to $6,000 for each employee that they pay up to $15,000 in the wake of Hurricanes Irma and María.

NIMB ON SOCIAL MEDIA