Puerto Rico Gov. Alejandro García-Padilla presented Thursday a consolidated budget of $29 billion and an operating budget of $9.83 billion for fiscal 2014, representing a $750 million increase when compared to the current budget, which he said will be covered with new revenue.

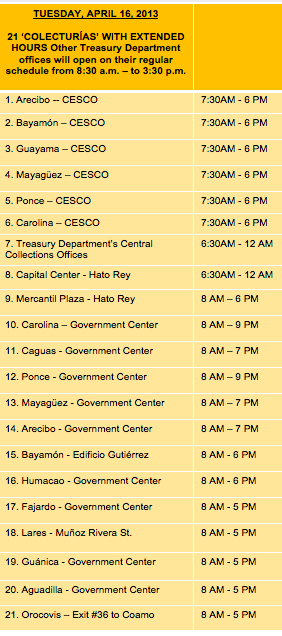

Thousands of last-minute taxpayers are expected to file their returns in Puerto Rico today, and the Treasury Department is responding by offering extended hours at 21 collections centers, and its headquarters in Puerta de Tierra, agency Secretary Melba Acosta said Monday.

The Puerto Rican government’s economic team is in Washington D.C. this week to “disclose and advance plans to stabilize the government's finances and revive the island’s economy,” the Treasury Department said Monday.

The Individual Retirement Account, best known as an IRA, is one of the few options that the Puerto Rico Internal Revenue Code provides as a tax shelter mechanism for tax relief when filing the income tax return. In addition, the IRA promotes the creation of a private and individual fund for the account holder’s eventual retirement.

The Puerto Rico Treasury Department is embarking on a pursuit of taxpayers who defrauded the government’s coffers either by under-reporting on their income taxes or failing to file altogether, agency Secretary Melba Acosta said Thursday.

Law 1 of January 31, 2011, also known as the Internal Revenue Code for a New Puerto Rico (herein the “New Code”), replaces the Internal Revenue Code of 1994, as amended. This New Code amends and adds new provisions to the previously known Section 1165, related to Puerto Rico Pensions Plans (now Section 1081.01). This article specifically refers to Chapter 8 — Trust and Successions, Subchapter A — Employees Trusts.

The tax season is again upon us, and with it, as taxpayers, we begin to wonder how much tax we are going to pay. Some of you might have done some preliminary calculations based on your expected income and based on the transactions that took place during the year.

Puerto Rico isn’t a country, so unlike most of its English-speaking Caribbean neighbors, it doesn’t have an embassy in Washington. And it’s not a state either, so it can’t send to Congress the eight lawmakers — two senators and six representatives — its population of 3.7 million would warrant under statehood.

WASHINGTON — Diplomats representing the 15-member Caribbean Community have begun a public lobbying campaign against the use of federal excise-tax rebates by Puerto Rico and the U.S. Virgin Islands to subsidize rum production.

Throughout Hato Rey’s Golden Mile, sotto voce, there is talk about an imminent amendment to Law 154 to increase taxes on foreign corporations. Under the present law, the excise tax on these corporations just declined from 4 percent in 2011, to 3.75 percent in 2012, and effective this month down further to 2.75 percent.

The Puerto Rico Manufacturers Association’s Tax Affairs and Buyers and Suppliers tems will host a workshop to explain to controlled foreign corporations doing business on the island how to reduce operational costs. The seminar also targets local “critical suppliers,” who will learn how to boost their sales.

Treasury Secretary Juan Carlos Méndez confirmed Wednesday that General Fund collections for FY 2012 ending June 30 reached $8.6 billion, exceeding the government’s goals by $10 million.

Net revenue making its way to the Puerto Rico government’s General Fund exceeded $1.2 billion in April, with personal and corporate income tax collections representing 69 percent, or $830 million of the month’s total, agency Secretary Jesús Méndez said Monday.

Doral Bank has reached a deal with the Treasury Department regarding $200 million in overpaid taxes that the bank will now write off in its books as a prepaid expense.

NIMB ON SOCIAL MEDIA