P.R. Treasury: At $676M, Oct. revenues beat estimates

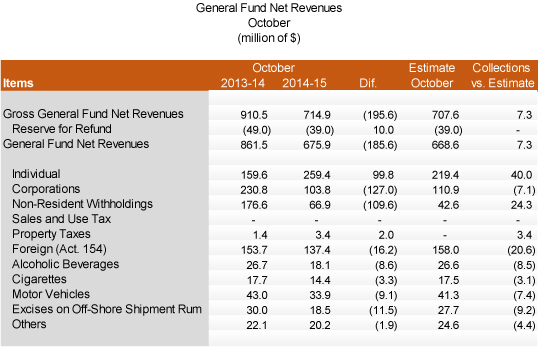

Puerto Rico General Fund revenue collections reached $676 million in October, beating government estimates by $7 million. However, the results were $185.6 million less when bumped up against October 2013 figures.

In a press release issued Wednesday, Interim Treasury Secretary Karolee García-Figueroa said the results could not be compared equally, given that two line items — corporate income tax and non-resident withholding revenues — included $237 million in nonrecurring revenues.

October 2013 corporate income tax revenues included approximately $100 million from Act 117 of 2013, which provisionally provided that in October 2013, half of corporate estimate taxes would be paid by corporations whose basis was the calendar year. This provision did not affect collections in October 2014.

On the other hand, October 2013 non-resident withholding receipts, which included corporate royalty withholding payments, were $137 million due to two also non-recurring payments in connection with U.S. Internal Revenue Service audits.

“October 2014 estimates took into account the effect for both line items, corporate and non-resident withholding revenues. Accordingly, despite a $110 million year-over-year decline, non-resident withholdings revenues exceeded estimates by $24.4 million,” García-Figueroa said.

Last month’s numbers results, meant that the difference between year-to-date actual revenues and estimates dropped to $29 million, or 1.2 percent in October, from $36 million, or 2 percent, in September, García-Figueroa pointed out.

The main driver of last month’s collections was individual income tax revenue totaling $259 million, for a year-over-year increase of $100 million, which was attributed to the effect of Act 77 of 2014 that granted a temporary period during which certain transactions could be prepaid, such as Individual Retirement Accounts (IRAs), retirement plans and other capital assets.

The temporary period ran from July 1, 2014 through Oct. 31, 2014. For annuity contracts, the period runs from July 1, 2014 through Dec. 31, 2014. Revenue from these transactions totaled $103 million in October 2014, and total revenue for the fiscal year-to-date is $110 million.

The Legislature, she said, is considering extending the deadline for the transactions related to IRAs and pension plans until the month of December for the benefit of taxpayers who were previously unable to avail themselves of this law.

Meanwhile, when broken down all of Treasury’s line items, with the exception of individual taxes and property taxes, all reflected year-over-year declines. Corporations contributed $127 million less year-over-year, non-resident withholdings dropped by $109.6 million, Law 154 corporations paid $16.2 million less, alcoholic beverages rang up $8.6 million less, as did motor vehicle excise taxes, which registered a $9 million reduction compared to October 2013.

However, the agency said Sales and Use Tax collections totaled $114 million in October, which represents a year-over-year increase of 7.6 percent, “the highest collections for a month of October since the SUT was implemented in November 2006. Fiscal YTD [July-October] SUT revenues totaled $452 million, for a year-over-year increase in adjusted revenues [excluding the effect of last year’s amnesty] of 6.3 percent, or $26.8 million,” she said.

So far this fiscal year, which began July 1, the government has shored up $110.6 million less into its coffers, when compared to the same period in 2013.