Sun West Mortgage announced the opening of third branch in Puerto Rico, which called for an investment of some $200,000, located at the Ciudadela complex in Santurce.

Banco Popular de Puerto Rico has agreed to acquire Wells Fargo & Company’s auto finance business in Puerto Rico, which operates as Reliable Financial Services Inc. and Reliable Finance Holding Company, for $1.7 billion, the financial institution announced.

An estimated 300,000 Banco Popular customers participated in Banco Popular de Puerto Rico’s loan moratorium program, which included personal, auto, leasing, and mortgage loans, as well as credit cards, bank officials said Thursday.

OFG Bancorp reported results for the fourth quarter and year ended Dec. 31, 2017, which reflected net income available to shareholders increased to $13.6 million, or $0.30 per share fully diluted, from a net loss of $146,000, or $0.00 per share, in 3Q17. OFG reported net income of $12.1 million, or $0.27 per share fully diluted, in 4Q16.

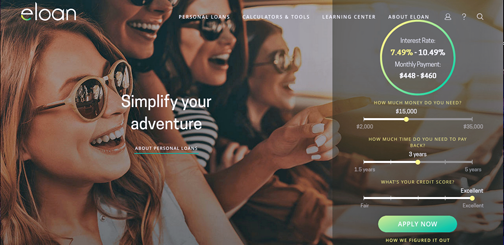

Two decades after pioneering in the digital banking solutions arena, online financial services platform Eloan is being relaunched to provide a “simpler and smarter” personal loans product at competitive rates, company officials said.

First BanCorp. reported net income of $24.2 million for the fourth quarter of 2017, or $0.11 per diluted share, compared to a net loss of $10.8 million, or $0.05 per diluted share, for the third quarter of 2017 and net income of $23.9 million, or $0.11 per diluted share, for the fourth quarter of 2016.

Popular Inc. reported a net loss of $102.2 million for the quarter ended Dec. 31, 2017, compared to a net income of $20.7 million for the prior reflecting a non-cash income tax expense of $168.4 million due to the impact of the Federal Tax Cut and Jobs Act in the corporation’s U.S. deferred tax asset.

First BanCorp., the bank holding company for FirstBank Puerto Rico, reported a net loss of $10.8 million for the third quarter of 2017 compared to net income of $24.1 million for the third quarter of 2016.

Popular Inc. reported a net income of $20.7 million for the third quarter ended Sept 30, 2017, compared to a net income of $96.2 million for the quarter ended June 30, 2017.

The impact of the back-to-back hurricanes — Irma and María — on the island has pushed Puerto Rico to “finally hit bottom,” said José Rafael Fernández, CEO of Oriental Financial Group Wednesday, upon announcing the bank’s third quarter results.

Popular Community Bank, the principal U.S. mainland operating subsidiary of Popular Inc., announced the official launch of its private banking division, Popular Private Client.

More than half, or 57 percent of Puerto Rico’s bank branches islandwide are offering services, Puerto Rico Bankers Association Executive VP Zoimé Álvarez-Rubio said.

First BanCorp. reported net income of $28 million for the second quarter of 2017, or $0.13 per diluted share, compared to $25.5 million, or $0.11 per diluted share, for the first quarter of 2017 and $22 million, or $0.10 per diluted share, for the second quarter of 2016.

Popular Inc. reported a net income of $96.2 million for the quarter ended June 30, 2017, up .08 percent compared to a net income of $88.9 million for the same year-ago quarter

Upon releasing second quarter results, Oriental Financial Group President José Rafael Fernández said despite solid performance, there is a “great deal of uncertainty” moving forward about the economic impact from Puerto Rico’s fiscal restructuring.

NIMB ON SOCIAL MEDIA