Eloan relaunches targeting consumers seeking ‘simpler, smarter lending’

Through Eloan, customers can apply for personal loans without an origination fee and have the money in their bank account as soon as the next business day.

Two decades after pioneering in the digital banking solutions arena, online financial services platform Eloan is being relaunched to provide a “simpler and smarter” personal loans product at competitive rates, company officials said.

Customers can now apply for personal loans without an origination fee and have the money in their bank account as soon as the next business day.

Established in 1997 — when it was known as “E-Loan” — and acquired in 2005 by Banco Popular de Puerto Rico, Eloan seeks to “become the best fully digital bank in the United States by offering smart and effectively simple financial solutions,” company executives said.

In its early days, the service pioneered the way the industry and consumers accessed mortgage, home equity and auto loans through an online channel, paving the way for innovation in the fintech space. Today’s Eloan continues the legacy of innovation led by a team from Banco Popular de Puerto Rico with a mission to transform data into smart, effective solutions tailored to empower enthusiasts and improve their quality of life.

Eloan’s new value proposition is to address the complexities that typically inhibit creditworthy consumers from applying for loans to help fund their goals while increasing the customer’s chances of being approved through a single application entry.

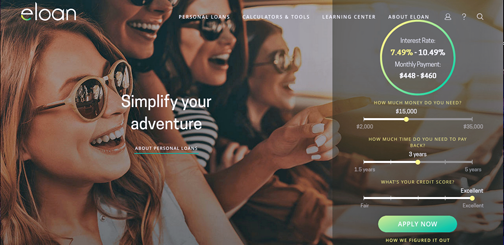

As part of the relaunch, Eloan augmented its technology capabilities and user experience by introducing a website that clearly mirrors their new slogan “simply smart.”

The new platform simplifies the experience of applying for a personal loan, leveraging technology to help consumers make smarter financial decisions for themselves. The total market for personal loans in the US is $112 billion. Eloan is targeting women, millennials, entrepreneurs and gen X-ers — who are looking for a simpler, smarter digital lending experience within the total Personal Loans market in the US.

“We identified a strong need for Eloan’s digital offering and, after extensive research and trials, we have created a simpler, smarter platform that balances technology, data and customer profiling while delivering a unique and effective banking experience,” said Mariel Arraiza, managing director of Eloan.

“We understand that our customers are people who stop at nothing and look for better financial solutions and we strive at simplifying their process to facilitate the achievement of their goals. Ultimately, our focus is the financial empowerment of our customers to improve their quality of life,” she said.

Users can navigate the Eloan website with their mobile devices or desktops and evaluate their credit options. Through an intuitive calculator on the home page, users can assess their monthly payments based on the amount, term and self-assessed credit score as well as include interest rates before they decide to apply. The process is simple and streamlined through one application with three different alternatives available to customers.

Partnership with Avant

To develop a “robust and efficient customer experience,” Eloan has partnered with Avant, an emerging technology leader providing banks with end to end digital banking products.

The custom technology platform allows visitors to apply for a personal loan through their mobile devices or desktops and receive an instant credit decision within seconds, without impacting their credit score.

Customers can evaluate their credit product options and complete the entire application process from their mobile devices or desktops. Eloan customers receive funds as soon as the next day and are serviced on Avant’s built in-house servicing platform, which is a white-labeled Eloan branded customer experience.

“We are committed to supporting Eloan’s mission of delivering world-class online experiences and are dedicated to expanding these capabilities for customers,” said Kevin Lewis, Avant’s VP of global business development.

“We are excited to partner with Banco Popular and Eloan and plan to add several new large bank partnerships as we expand our technology offering,” he said.

Eloan’s new platform includes the following features:

- Financial tools — In addition to a simple interface, Eloan provides calculators that anticipate monthly payments based on personalized credit scores to help customers decide on the right product that fits within their budgets.

- Home improvement tips and insights — Weekly content is uploaded providing guidance on home projects. With this feature, visitors can also access additional tools that assist with renovation and remodeling projects.