After suffering several years of substantial losses locally and stateside, Banco Popular has “solidified its capital base” and is “now poised to build upon its dominant position in Puerto Rico while returning its mainland operations to profitability,” investment banking firm B. Riley said in a report released Wednesday.

Gov. Luis Fortuño appointed former BBVA executive and banking industry veteran Rafael Blanco to head the Office of the Financial Institutions Commissioner, effective Jan. 1. Blanco will succeed current OCIF chief Alfredo Padilla, who will retire after nine years at the agency.

Doral Financial Corporation, the holding company of Doral Bank and Doral Bank FSB, reported a net loss of $30.2 million for the quarter ended Sept. 30, compared to a net income of $4.5 million for the prior quarter ended June 30.

Eighteen months after purchasing the failed R-G Premier Bank, Scotiabank of Puerto Rico will culminate the merger of both institutions by closing all of its 46 branches and central offices next Thursday afternoon and reopening them Monday, Nov. 14, upon completion of the integration.

Members of the island’s banking sector continue building on expanding the concept of “participatory democracy” through community reinvestment initiatives that are the focus of its 9th annual Community Reinvestment Week event that wraps up Friday.

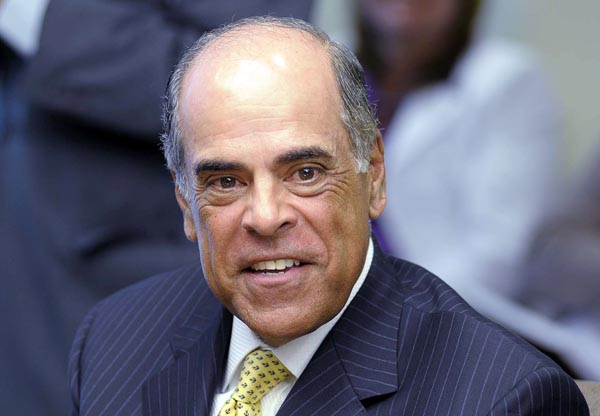

First BanCorp President Aurelio Alemán echoed Thursday what many other banking executives have been saying in recent months: the sector is slowly starting to pick up the pieces after the storm, but much work remains ahead for it to thrive again.

Popular Inc. sailed through its third consecutive quarter on the positive side, reporting $27.5 million in net income for the three-month period ended Sept. 30. The results were fueled by the sale of its non-performing loan portfolio and investment securities available-for-sale.

First Bancorp’s recently completed $525 million capital raise will enable it to be “more aggressive” in resolving its problem loans and putting itself back on the path of profitability, research, trading and investment banking analyst firm B. Riley said Monday.

First BanCorp, parent company for FirstBank Puerto Rico announced Friday it has completed its previously announced capital raise of $525 million of common stock to institutional investors Thomas H. Lee Partners, L.P. and Oaktree Capital Management, L.P.

BBVA Puerto Rico announced Thursday it will be pumping more than $1 million to begin remodeling its branches to match them with the banking group’s global corporate identity. The transition, which also calls for changing the appearance of its credit and debit cards, as well as other day-to-day elements, should be finished by the first quarter of next year, company officials said.

Popular Inc. announced Thursday that its subsidiary Banco Popular de Puerto Rico, completed the sale of a portfolio of mostly non-performing construction and commercial real estate loans with a book value of about $148 million. The loans carry an unpaid principal balance of approximately $358 million, the financial institution announced late in the day.

Given that more than half of the island’s population is female and that women represent 45 percent of Puerto Rico’s labor force, it should come as no surprise that they should deserve to get financial and professional support to continue to thrive in their careers.

Last weekend, a woman was at home in Orlando, when she got a call from her bank warning her of a potentially fraudulent transaction involving her debit card. Someone had lifted the card number to go on a $150 shopping spree at a mega-retailer in Canóvanas, miles from where she was in Florida.

First BanCorp, parent company for FirstBank Puerto Rico, announced that it has received approval at the special meeting of stockholders held earlier today to issue 150 million shares of its common stock for $3.50 per share to institutional investors.

The Federal Home Loan Bank of New York announced Tuesday it will be providing up to $500 million in disaster relief loans to help communities affected by Hurricane Irene begin the process of rebuilding.

NIMB ON SOCIAL MEDIA