OBoard submits $13.1B budget for FY2026 developed with local gov’t

The proposed budget includes reclassified revenues and tools to manage federal aid uncertainty in Puerto Rico.

The Financial Oversight and Management Board for Puerto Rico has submitted a proposed $13.1 billion General Fund budget for fiscal year 2026 to the Legislative Assembly, marking the first time the spending plan was developed jointly with Gov. Jenniffer González’s administration.

The proposed budget represents a 1.5% increase over the certified fiscal year 2025 budget. It was developed with assistance from the Office of Management and Budget and aligns with the current Fiscal Plan for Puerto Rico.

According to the oversight board, the budget includes a reclassification of certain General Fund revenues as special revenues to reflect a change in fiscal methodology.

“I’m extremely grateful for the close collaboration between my fiscal team and the Financial Oversight Board in being able to work together on this budget, which keeps public spending practically intact while focusing on addressing critical areas in which I uphold my commitment to the people,” González said. “Among them are doing justice to our retirees, the safety of our residents and guaranteeing access to health care for our people.”

González added that the change in budget methodology signals the administration’s readiness to manage the fiscal year 2027 budget independently.

“We will continue working in collaboration with the oversight board and the Legislative Assembly to ensure that this budget is successfully implemented and benefits all Puerto Ricans,” she said.

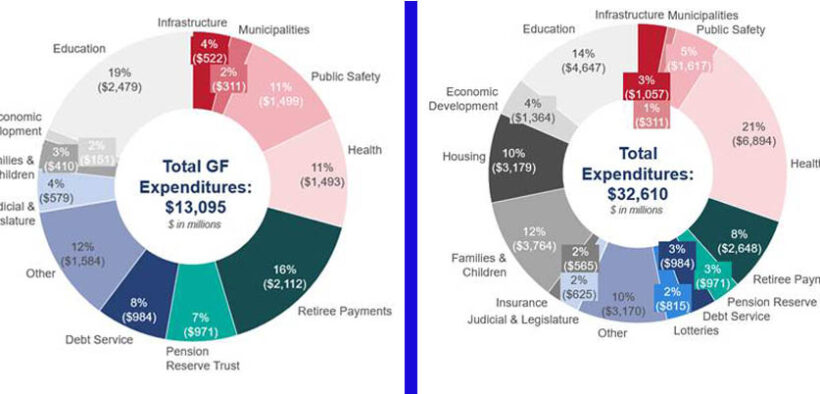

More than 64% of the General Fund — approximately $8.6 billion — is allocated to education, health care, public safety and pensions. The increase is tied to one-time investments intended to strengthen long-term fiscal sustainability without creating new recurring obligations.

“This budget reflects the knowledge we have today — and Puerto Rico’s fiscal reality today,” said board Executive Director Robert Mujica. “The budget illustrates that the fiscal responsibility we instilled in previous years puts the Commonwealth in a better position to respond to the changing federal funding landscape.”

Mujica said uncertainty around federal funding remains a key concern.

“Like many states, municipalities and territories across the U.S., we may have to revisit the budget with the Governor and Legislature if federal funding levels change,” he said.

To prepare for those scenarios, the budget includes holdbacks, reserves and tools to redirect funds if needed. Some funds for expanded services will remain on hold until federal aid levels are confirmed.

The General Fund does not include special revenues or federal funds. When combined, Puerto Rico’s consolidated budget for fiscal year 2026 totals $32.6 billion.

At González’s request, the board agreed to reclassify the excise tax on rum producers from the General Fund to the special revenue fund, reducing the General Fund total from an initial $13.3 billion to $13.1 billion.

The board and the Legislative Assembly will continue working on the budget until June 3, the deadline for the Legislature to submit its version for review. The final budget is scheduled for certification by June 30, before the new fiscal year begins on July 1.